From The Developing Economist VOL. 2 NO. 1China and India in Africa: Implications of New Private Sector Actors on Bribe Paying Incidence

IN THIS ARTICLE

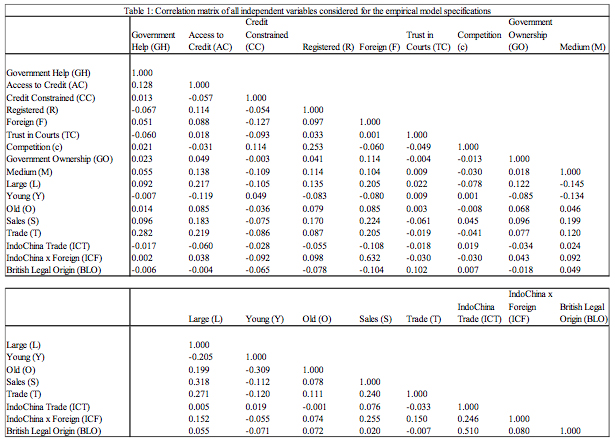

AbstractThis paper seeks to address one of the most common critiques of Asian firms doing business in Africa: that low levels of corporate governance and poor managerial practices have undermined anti-corruption efforts throughout the continent. The paper first details and analyzes the managerial practices of Indian and Chinese firms to distinguish what factors might make these firms more likely to pay bribes. Next, it uses data from the 2006-2014 World Bank Enterprise Surveys to empirically test the claim that the presence of Indian and Chinese firms has increased bribe-paying incidence in African countries. I find the result that firms operating in countries with large Indian and Chinese involvement are significantly less likely to engage in bribe paying. This is promising evidence against the "race to the bottom" scenario that many Western firms and governments have complained of in response to the growing Asian presence in Africa. I. IntroductionOver the course of the past decade, African nations have increasingly adopted a new view toward development that focuses on bolstering private sector growth through investment and trade. Driven by mounting criticism of the effectiveness of foreign aid dollars and cynicism toward the sustainability of development priorities set by Western nations, this move has coincided with the rise of India and China as global economic powers. Indian and Chinese firms have stepped in to fill the investment gap left in emerging economies by more cautious Western investors, and have heavily prioritized building SouthSouth relationships over the past several years. The economic significance of this trend is remarkable. The global south was responsible for 34% of all foreign direct investment to the developing world in 2010 and China's outward FDI to the south alone totals over $1 trillion (Puri, 2010; World Bank, 2011, 23). Additionally, South-South exports grew to $4 trillion in 2011 and increased from 13% of world exports in 2001 to 25% in 2011 (UNCTAD, 2013, 1). Although not all of these flows have been directed at African nations, they have undoubtedly played a significant role in contributing to the continent's 4% growth rate in 2013, helping Africa top the global average of 3% (African Economic Outlook, 2014). Understandably, this growth rate and these trends do not extend to all African nations, and Indian and Chinese involvement has been limited to a number of key countries. Primary among these are the oil and mineral rich Nigeria, Sudan, and Zambia that are critical to meeting Indian and Chinese demand for resources, but others include Botswana, Ethiopia, Kenya, Madagascar, Mauritius, Mozambique, Senegal, South Africa, and Uganda where investment has extended into a much broader range of sectors (Broadman, 2008). Although many applaud Indian and Chinese firms for boosting competition, providing access to new global supply chains, and producing learning effects through technology and knowledge transfers, their reception in these countries has been mixed. Common critiques of foreign firms from Asia include the undercutting of local wages/exclusion of the local labor market, quality concerns over working conditions and outputs, and the central focus of this paper: low levels of corporate governance that could undermine anticorruption efforts. This last view is well represented by Western donors and businesses. During a 2012 speech in Senegal, former Secretary of State Hillary Clinton took an indirect jab at India and China when she stated, "The USA stands for democracy and human rights, even when it's easier or more profitable to look away in order to secure resources." (Deutsche Welle, 2012). Business leaders echo this sentiment and point to anticorruption legislation such as the United States's Foreign Corrupt Practices Act and the lack of similar legislation in India and China as an inherent disadvantage for Western firms (Wall Street Journal, 2014). The implication is clear: Indian and Chinese firms have been eclipsing Western investors through bribe paying and other corrupt practices. While India and China have been quick to refute such claims, they continue to cast a shadow over further investment efforts. Notably, much of this criticism has been directed toward Chinese firms while Indian firms have for the most part escaped relatively unscathed.This paper seeks to deconstruct the impact of Indian and Chinese firms as new private sector actors on bribe paying incidence in the African region. Section 1 describes important differences in each nation's approach to investing in Africa. Section 2 discusses how these differences might affect the supplyside of corruption through management practices that tolerate or even embrace bribery. Section 3 summarizes literature regarding institutional drivers of corruption at the firm level that theoretically affect all firms operating in Africa. Section 4 outlines the data and methodology of my empirical analysis and Section 5 presents preliminary empirical findings from the World Bank Enterprise Surveys. I conclude with policy implications and suggestions for areas of further research. I find that evidence from the Enterprise Surveys supports the surprising result that firms operating in countries with large Indian and Chinese involvement are significantly less likely to engage in bribe paying. However, this result might be driven more by institutional environment than by firm activity. This evidence alone is not enough to exculpate Indian and Chinese firms specifically from any wrongdoing, but it is promising evidence against the "race to the bottom" hypothesis that has been raised against foreign firms operating in Africa. Ultimately, more detailed data will be required to conclusively gauge the impact of Indian and Chinese firms on corruption in the African private sector. II. The Indian vs. Chinese Approach to FDI in AfricaOf the two countries, China remains the dominant player in Africa, with approximately $119.7 billion dollars in FDI outflows to the continent between 2007 and 2012 compared to India's $27.3 billion (Fortin, 2013, Ernst Young, 2013). Although these numbers still lag far behind those of Western countries like the United States, United Kingdom, and France, China has managed to become Africa's largest trading partner, surpassing the United States in 2009. The majority of China's investments are in resource intensive industries, particularly oil and natural gas, as it depends heavily on Africa for its energy needs (approximately one-third of its crude oil comes from Africa). Its investments in these industries have been accompanied by large-scale infrastructure projects in roads, ports, and buildings, adding to its visibility on the continent (Alessi Hansion, 2012; Khare, 2013). The size of these contracts also means that the majority of these investments are made at the state-state level through state-owned enterprises (SOEs) or sponsored by state agencies such as China's ExIm Bank (The Economist, 2011). Starting in 2010, this trend has shifted toward a more diversified set of industries, with transportation, agriculture, and real estate investments eclipsing natural resource investment (Caulderwood, 2014). China's centralized approach to investment on the continent has been backed by high-level visits from President Xi Jinping in 2013 as well as by former President Hu Jintao throughout the 2000s. As a result of its growth and heavy involvement in Africa's capital-intensive industries, China has garnered more attention than any other investor in recent years. India, on the other hand, operates by virtue of a very different model. Although its state-owned energy companies pursue India's interests in African resource markets in the same manner as China's, the majority of its investment in Africa is led by the private sector (Jacobs, 2013). This is reflected by the fact that although India's FDI outflows were only onefifth of China's, India was responsible for 56% more new FDI projects than China between 2007 and 2012 (Ernst Young, 2013). These projects represent a far more diversified portfolio of smaller investments than China's, and India is known for its presence in a broader range of sectors. These sectors include agriculture, IT, telecommunications, and healthcare/ medicine. Interestingly, these are sectors that avoid direct competition with Chinese investments in Africa, a product of private financing and a more traditional program of risk assessment spurred by a lack of central state backing. Among the largest private sector actors in the Indian expansion into Africa are globally well-known and regarded firms such as the Tata Group, Godrej, and Bharti Airtel (Indo-African Business Magazine, 2011). Indian and Chinese firms are further differentiated by their level of integration within local African economies (The Econ omist, 2013b). The Indian presence in East Africa has existed for more than a century, and the two regions are bound by a common colonial legacy. Furthermore, the strong, integrated Indian diaspora serves as a natural base to promote Indian interests in the region. This translates to a smaller language and culture barrier than that faced by Chinese firms. Additionally, a survey of Indian business leaders actively investing in Africa undertaken at the most recent WEF India Economic Summit in 2014 reported a hiring target for local employees of 90% and a new push to produce certain types of products in Africa instead of focusing on selling finished goods (Vanham, 2014). Chinese involvement has meanwhile been seen as the more foreign of the two and has at times evoked a xenophobic response from local populations. Some countries such as Malawi, Tanzania, Uganda, and Zambia have responded by restricting the sectors in which Chinese firms can operate. This suspicion is in part due to protectionism by African businesses, but it remains one of China's biggest hurdles in Africa (The Economist, 2013a). Even more serious incidents such as recurring riots over working conditions in Zambian mines also continue to color popular perception of China as the continent's new neocolonial power. III. The Supply-Side of CorruptionIt is clear that Indian and Chinese firms have vastly different approaches to doing business in Africa. Deconstructing these differences further could provide insight into how their management practices might affect the supply-side drivers of corruption. Given that the Western critique of Indian and Chinese firms is focused here, this is a subject worth exploring despite a paucity of existing literature. In mainland China, it is well documented that bribe paying and other forms of corruption are common business practice, reflected by China's rank as 100th out of 175 countries on Transparency International's Corruption Perceptions index (Transparency International, 2014). The business culture is reliant upon relationships and "gifts," even in the private sector. Cai, et al. (2011) use a conceptual management theory of the Chinese firm to empirically show that entertainment and travel costs, a common category in most Chinese firms' financials, is often used as a proxy for dollars spent on bribe paying or other similar activities (Cai, et al., 2011) . Similarly, anecdotal evidence from Chinese firms in Africa supports the theory that these practices have been exported overseas. Chinese managers have been documented bribing union bosses with fake "study tours" to China to avoid censure over poor working conditions (The Economist, 2011). Additionally, there are numerous cases of Chinese SOEs like Nuctech Company at one point managed by President Hu Jintao's son becoming the subject of both African and European anti-corruption probes (Gordon, et al., 2009). While the majority of these cases are on a smaller scale, a recent incident with Sicomines, a Chinese state-owned mining company, gives a better sense of the how much money can change hands in one of these transactions. The company recently signed a $6.5 billion deal with the Democratic Republic of Congo that included a $350 million "signing bonus." According to accountability NGO Global Watch, $24 million of this bonus made its way to secret bank accounts in the British Virgin Islands rather than into the DRC's treasury (Kushner, 2013). India, at 85th on Transparency International's Corruption Perceptions Index, is not necessarily a much better contender for clean management practices in its own private sector (Transparency International, 2014). Aside from a more limited relationship with the state and a more traditional business perspective on risk management that might preclude firms from entering a corrupt market where costs are higher, there is little to indicate that Indian firms are less likely to engage in bribe paying than Chinese firms. Interestingly, however, a 2013 Transparency International study of BRICS firms operating in emerging markets ranked Indian firms first in transparency while Chinese firms ranked last. The rankings cited key Indian laws requiring publication of certain financial information as the driving force behind the relative transparency of Indian firms. Additionally, with more publicly listed companies on the list, Indian firms performed better than other BRICS nations that had more state or private-owned firms. Publicly listed companies are more accountable to shareholders and typically have more disclosure requirements. Tata Communications, the Indian firm that topped the list, also incorporated several additional measures into its corporate governance structure that included bribe reporting and whistleblower protection (Gayathri, 2013). However, Transparency International's rankings should not mask the fact that even Indian firms are far from perfect. Mining conglomerate Vedanta, which operates globally and has multiple investments in Africa, was found guilty of rampant corruption in India throughout the 2000s (Rankin, 2013). These practices may very well be replicated in Africa; as recently as 2011, Vedanta acquired a Liberian iron ore company that was being investigated by the Liberian anti-corruption committee. Such deals demonstrate the low emphasis that some Indian firms like Vedanta place on corruption in their risk assessment practices (Financial Times, 2011). Even Bharti Airtel, which ranked fourth on Transparency International's list of most transparent firms, is currently facing charges of corruption in India over suspicious dealings with former Telecom Minister Andimuthu Raja. Since 2013, the chairman of Bharti Airtel has refused to answer his summons to testify in the case and has escalated the issue of his appearance to the Indian Supreme Court (Rautray, 2014). Although this evidence is only anecdotal, it is a good indication that management practices even among large publically traded Indian firms may mirror those of China's state-owned enterprises. From the supply-side perspective, both Indian and Chinese management practices appear to incorporate bribery and similar tactics in spite of numerous domestic anti-corruption laws. As two countries that rank relatively low on the Corruption Perception Index, this is not altogether surprising. However, in terms of how these practices transfer overseas, it is important to recognize that Indian and Chinese firms may not always perform worse than Western firms. Returning to the example of mining in the Democratic Republic of the Congo, the 2009 COMIDE deal is an example of how questionable circumstances led to the sale of the DRC's 25% stake in a copper mining venture to a European multinational headquartered in London (Kushner, 2013). DRC officials who signed the deal failed to disclose the sale to the public, in violation of a conditional development loan from the International Monetary Fund. Ultimately, the IMF declined to renew its loan as a direct result of the COMIDE incident and the DRC forfeited valuable development funds. Western firms might face greater regulation but this does not always translate to more reliable accountability. IV. Firm-level Determinants of CorruptionIn addition to the supply-side determinants of corruption, bribery is also a result of the institutional investment climate in the countries where firms operate. Fitting within the traditional definition of corruption as public officials' abuse of their office for private gain, the demand side of corruption allows us to identify firm-level characteristics for which firms are asked to pay bribes. In the empirical analysis that follows this section, these firm-level determinants will serve as a baseline to gauge if foreign firms are more likely to pay bribes in Africa as a whole, and to provide a rough estimation of the potential supply-side impact of Chinese and Indian firms in the countries where they operate. There are three primary hypotheses regarding firm-level determinants of corruption in the existing literature: the Control Rights hypothesis, the Bargaining Power hypothesis, and the Grease the Wheels hypothesis. Control Rights is based most heavily on the definition above, and focuses on public officials' opportunity to extract bribes. A firm's required dealings with the public sector for services such as water and electricity determine the firms' dependency on public officials and its exposure to corruption risk (Svensson, 2003). By this logic, a firm that is more frequently in contact with the public sector is at increased risk of needing to pay a bribe. Bargaining Power refers to a firm's position to refuse paying the bribe, quantifiable by its relative cost of exiting the market. If the cost of paying the bribe is greater than the firm's cost of exiting, firms can more credibly refuse to pay the public officials (Svensson, 2003). This also holds in the opposite sense that stronger performing firms, i.e. those that are more profitable or solvent, will face more solicitation for bribes from savvy corrupt public officials. Lastly, Grease the Wheels refers to a mixed supply/ demand explanation for bribe paying where firms bribe in order to circumvent or speed up procedures in an otherwise burdensome administrative environment (Alaimo, et al., 2009). Firms that are in this situation (i.e. our foreign Chinese and Indian firms) will pay bribes to gain an advantage over competitors or simply to respond to inefficient institutions in the operating country. Because these institutional determinants of corruption theoretically extend to all private sector actors operating within the same industry and country/region, they serve as a good baseline lens through which to view corruption. The empirical evidence on each of these hypotheses is mixed, and varies based on the level of analysis country, regional, or global. Several key examples include Svensson (2003), Alaimo, et al. (2009), and Chen, et al (2008). Svensson (2003) tests the Control Rights and Bargaining Power hypotheses using survey data from Ugandan firms, and finds that both are powerful predictors of not only which firms pay bribes, but also how much they must pay. Alaimo, et al. (2009) test all three hypotheses at the regional level for Latin American firms and find support for Control Rights and Grease the Wheels, but do not find evidence in support of Bargaining Power. Chen, et al. (2008) conduct a cross-country analysis that incorporates the first two hypotheses (and implicitly the third) as well as several macro-level determinants of corruption. The authors find that certain firm characteristics, such as dependence on infrastructure, likelihood of going to an alternative authority, and number of competitors, are significant determinants of corruption that function similarly to the three hypotheses. They also find that certain macro-level determinants such as British legal origin and average years of schooling are significantly correlated with lower levels of firm-level corruption, while population is a significant and positive determinant of corruption. The following empirical section will draw primarily on the techniques used by these authors as applied to the World Bank Enterprise Surveys Standardized dataset from 2006-2014.Continued on Next Page » Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |

![Table 2: Parameter estimates from the probit regression [Dependent Variable = BD]](http://www.inquiriesjournal.com/article-images/j17/i74/a1459540500/a3fa80.jpg)