|

Featured Article: Roosevelt's Recession: A Historical and Econometric Examination of the Roots of the 1937 Recession

In response to the Depression, Keynes developed new economic theories that questioned an orthodoxy accepted for centuries in the English-speaking world. Until the early 1930s, classical economics was the prevailing school of thought in Britain, and to a lesser extent, the United States. The roots of classical economics can be traced to Adam Smith’s magnum opus, The Wealth of Nations (1776). Smith’s book made commonplace the belief that free markets were guided by an “invisible hand.” The history of economic thought is punctuated by pioneering figures, like Smith. These individuals fundamentally altered existing theories, and oftentimes, served as key public figureheads.

In the two decades leading up to 1930, Irving Fisher was as the center of American economics. Fisher studied at Yale and obtained his undergraduate degree in 1888 and his Ph.D. in 1891. At Yale, Fisher found himself surrounded by Progressive-Era economists who, unlike their British counterparts, largely rejected laissez-faire principles. Unlike economists today, mainstream economists in the late 1800’s had greater flexibility to hold reform-minded views because the profession had not yet fully professionalized, nor had it developed grounding in statistical analysis.

In 1896, Arthur Hadley, later to serve as President of Yale for twenty-two years, critically referred to American economists as “a large and influential body of men who are engaged in extending the functions of government.” Fisher strongly agreed with Hadley. During his studies, Fisher became increasingly disgruntled with the views of his peers and professors. Fisher’s theoretical interests stood in contrast of the reform-minded economists, like E.R.A. Seligman, who were at the forefront of American discourse during the three-decade period before the Great War.

Fisher eventually found a comfortable niche at Yale. He tailored his studies and flocked to courses led by William Graham Sumner, the Chair of Political Economy. Sumner was a polarizing figure who held contrarian views; unlike his colleagues, Sumner was a staunch advocate of laissez-faire economics. Fisher leaned towards laissez-faire economic thought, and he believed the discipline should free itself from its early roots in philosophical inquiry. Fisher desired a rigorous analytic model of study that yielded conclusive answers; he wanted to push the field towards the realm of the sciences.

Sumner advised Fisher to write a dissertation using mathematical economics, a field still in its infancy. Fisher believed that “before applying political economy to railway rates, to the problems of trusts, to the explanation of some current crisis, it is best to develop the theory of political economy in general.” Adhering to this desire, Fisher set out to create one of the first mathematical models of an economy. Fisher included a model in his dissertation, titled “Mathematical Investigations in the Theory of Value and Prices.” His thesis was widely and highly praised. Paul Samuelson, the first recipient of the Nobel Memorial Prize in Economics, proclaimed Fisher’s work as “the greatest doctoral dissertation in economics ever written.”

Fisher’s model was a hydraulic machine that calculated equilibrium prices. Fisher’s highly complicated hydraulic contraption was a simplified representation of the interrelated nature of the economy. Although a simplified rendition of the economy, the machine represented the markets at work. As Fisher grew older, he strayed from strict adherence to laissez-faire economics. In a 1906 piece, he declared that government had a role to play in the economy because markets could not always be trusted to act in the best interest of society. A middle ground was needed because, as he noted, "We are today in danger of too much socialistic experimentation; but nothing can be gained... by ignoring or condoning the opposite evils of individualism.” The idea he hints at is an externality, a concept formally introduced by Pigou in 1920.

Figure 4. Diagram of Fisher's Equilibrium Machine. Source: Fisher, "Mathematical Investigations in the Theory," 38.

In the two decades since 1906, Fisher’s work in the field of monetary economics gained an audience in England with Keynes. Both Fisher and Keynes viewed the stability of a currency’s purchasing power as the antidote to gluts and instability.

Fisher viewed not the gold standard problematic, but the way it was used; a unit of money was tied to a weight of gold, not to a unit of purchasing power. In regards to the price level, Fisher believed, "The so-called ‘level of prices’ is largely at the mercy of monetary and credit conditions. The tide of prices will rise or fall with the flood or ebb of gold or of paper money or of bank credit. Evidently a rise in the level of prices is a fall in the purchasing power of the dollar or other monetary unit, and vice versa.”

To remedy this inherent instability, Fisher believed government had to maintain a constant purchasing power by varying the weight of a gold dollar. Under his proposal, the price of gold bullion would vary relative to commodity prices.

The recession experienced in 1920-1 inspired Fisher to relate fluctuations in the supply of money to booms and busts. World War One brought with it a 147% increase in the wholesale price level between June 1914 and May 1920. To combat inflation, the Federal Reserve Bank of New York rapidly increased the discount rate, and the system’s other banks followed New York’s lead. In the seven months between November 1919 and June 1920, the discount rate increased from 4% to 7%. The rate increase was unprecedented, and by 1921 it became evident that the Federal Reserve had achieved its goal of deflating the economy. Unfortunately, the economy deflated to an undesirable extent, and a deflationary recession was underway. Whether Lebergott’s or Romer’s historical unemployment rate calculations are considered, the unemployment rate essentially doubled between 1920 to 1921.

The experience of 1921 led Fisher to explore the relation between the price level and unemployment. Whereas his predecessors found no link between the price level and the unemployment rate, Fisher uncovered the existence of a relationship between the rate of change of the price level and the unemployment rate. With this discovery, Fisher started to advocate for intervention aimed at price level stabilization. In a 1923 letter to the editor of the New York Times, Fisher criticized an editorial that argued against Keynes’ advocacy of price stabilization. In his letter, Fisher drew a distinction between prices and the price level. While “prices should be left to supply and demand,” Fisher noted that, “This does not, or should not, mean that the price level should be left to supply and demand.”

Two years later, Fisher published an article where he argued that variations in economic activity, as measured by Warren M. Persons’ index of trade, could be largely attributed to the rate of change in the level of prices. In his conclusion, Fisher noted that “the so-called ‘business cycle’… seem[s] to be largely mythical.” In the decade preceding the Depression, one of America’s leading economists increasingly started viewing business cycles as a monetary phenomena. The Depression finally crystalized Fisher’s views on the causes of economic downturns, and he became one of the first modern monetarists.

In 1932, Fisher published Booms and Depression. The book introduced a theory of economic cycles called debt deflation, a theory that pins the roots of economic downturn to deflating levels of debt. The following year, Fisher expanded his theory and summarized his theory’s chain of events for readers:

Assuming a state of over-indebtedness exists, this will tend to liquidation through the alarm either of debtors or creditors or both… (1) Debt liquidation leads to distress selling and to (2) Contraction of deposit currency… This contraction of deposits and of their velocity, precipitated by distress selling, causes (3) A fall in the level of prices… Assuming, as above stated, that this fall of prices is not interfered with by reflation or otherwise, there must be (4) A still greater fall in the net worths of business, precipitating bankruptcies and (5) A like fall in profits, which in a "capitalistic," that is, a private-profit society, leads the concerns which are running at a loss to make (6) A reduction in output, in trade and in employment of labor. These losses, bankruptcies, and unemployment, lead to (7) Pessimism and loss of confidence, which in turn lead to (8) Hoarding and slowing down still more the velocity of circulation. The above eight changes cause (9) Complicated disturbances in the rates of interest, in particular, a fall in the nominal, or money, rates and a rise in the real, or commodity, rates of interest.

In the book, Fisher included a twenty-one page chapter that outlined remedial policy, mainly monetary, to be taken during downturns. As the final remedial step “needed only in emergencies,” Fisher listed “stimulating borrowers and buyers” through “stamped dollar” subsidies that lost value over time. Throughout the New Deal, Fisher maintained that private industry subsidies were preferable to the “slow, clumsy, inefficient and costly” government-led public work programs.

Fisher’s research and beliefs led him to energetically lobby for public policies during the Depression and the Recession. From 1933 to 1939, he wrote more than one hundred letters to President Roosevelt. Although overshadowed by Keynes and somewhat sidelined by the President, Fisher continued pressing for the adoption of his remedies. These solutions, however, all but excluded fiscal policy measures; his roots in laissez-faire thought started showing. In a 1934 response to the price setting measures of the Agricultural Adjustment Act (1933) and the National Recovery Administration (1933), Fisher informed the President of his objection to “the philosophy of wealth destruction and limitation as a means of enhancing the money values for certain classes at the expense of the nation as a whole.” He pointedly added, “On this matter some of the ‘brains trust’ do not seem to have brains to trust.”

On the brink of the Recession and after successful Depression recovery efforts, Fisher again wrote to the President on October 24, 1937 to argue “it was not government expenditure which pulled us out of the depression… [but rather the expansion of] check-book money which turned over twenty times a year.” The full onset of the Recession brought Fisher a feeling of personal failure. In a letter to his wife on December 12, 1937, Fisher said, “I’m going to make a desperate effort to stick a pin in F.D.R.” In the same letter, he also reflected on his inability to sway Roosevelt: “Why couldn’t I have influenced the President more and earlier! I suppose it’s my shortcoming.”

That same month, Fisher wrote to Marriner Eccles, the Chairman of the Board of Governors of the Federal Reserve System, and presented his views on the Recession. His first point declared that “this ‘recession’ is very largely monetary,” while in his second point, he agreed with Eccles’ view that “the ‘monopoly’ price of labor is largely responsible for unemployment.” As will be later discussed, some economists have considered this wage increase, brought about by the Supreme Court’s upholding of the 1935 National Labor Relations Act, one of the more minor causes of the Recession. However, it is overwhelmingly rejected as a contributing factor.Continued on Next Page »

An Act to Diminish the Causes of Labor Disputes Burdening or Obstructing Interstate and Foreign Commerce, to Create a National Labor Relations Board, and for Other Purposes., Pub. L. No. 74-198, Stat. (July 5, 1935). Accessed January 16, 2015. http://research.archives.gov/description/299843.

An act to provide adjusted compensation for veterans of the World War, and for other purposes., H.R. 10874, 67th Cong., 2d Sess. (1922).

Adjusted Compensation Payment Act, ch. 32, 49 Stat. 1099-1102 (Jan. 27, 1936).

Allen, William R. "Irving Fisher, F. D. R., and the Great Depression." History of Political Economy 9, no. 4 (1977): 560-87. http://EconPapers.repec.org/RePEc:hop:hopeec:v:9:y:1977:i:4:p:560-587.

Baker, Nancy. "Abel Meeropol (a.k.a. Lewis Allan): Political Commentator and Social Conscience." American Music 20, no. 1 (Spring 2002): 25-79.

Barber, William J. From New Era to New Deal: Herbert Hoover, the Economists, and American Economic Policy, 1921-1933. Cambridge: Cambridge University Press, 1988.

Black, Conrad. Franklin Delano Roosevelt: Champion of Freedom. New York: Public Affairs, 2003.

Board of Governors of the Federal Reserve System (US), Industrial Production Index[INDPRO], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/INDPRO/, April 4, 2015.

Brown, E. Cary. "Fiscal Policy in the 'Thirties: A Reappraisal." The American Economic Review 46, no. 5 (December 1956): 857-79.

The Brownsville Herald (Brownsville, TX). "Prices." April 2, 1937, 1.

The Brownsville Herald (Brownsville, TX). "Public Funds Will Control High Prices?" April 4, 1937, 1-2.

Burns, Arthur F., and Wesley C. Mitchell. Measuring Business Cycles. Studies in Business Cycles 2. New York: National Bureau of Economic Research, 1946.

Cargill, Thomas F., and Thomas Mayer. "The Effect of Changes in Reserve Requirements during the 1930s: The Evidence from Nonmember Banks." The Journal of Economic History 66, no. 2 (June 2006): 417-32.

Cole, Harold L., and Lee E. Ohanian. "New Deal Policies and the Persistence of the Great Depression: A General Equilibrium Analysis." Journal of Political Economy 112, no. 4 (August 2004): 779-816. Accessed January 16, 2015. doi:10.1086/421169.

Complete Set of Speech Drafts. Volume 97: November 10, 1937. Diaries of Henry Morgenthau, Jr. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

Conference to Talk Over Plans, 9/13/37. Volume 95: November 10, 1937; Page 1. Diaries of Henry Morgenthau, Jr. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

"Document 50: February 28, 1938, Letter with Attachments, To: Keynes From: Roosevelt." In FDR's Response to Recession, edited by George McJimsey, 303-12. Vol. 26 of Documentary History of the Franklin D. Roosevelt Presidency. N.p.: University Publications of America, 2005.

Draft Letter to FDR. November 3, 1937. Volume 94: November 1-November 10, 1937; Page 47. The Diaries of Henry Morgenthau, Jr. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

Dutcher, Rodney. "Behind the Scenes in Washington." The Brownsville Herald (Brownsville, TX), April 2, 1937, 4.

Edsforth, Ronald. The New Deal: America's Response to the Great Depression. Malden, MA: Blackwell Publishers, 2000.

Eggertsson, Gauti B. Great Expectations and the End of the Depression. Staff Report no. 234. N.p.: Federal Reserve Bank of New York, 2005.

———. "Great Expectations and the End of the Depression." American Economic Review 98, no. 4 (September 2008): 1476-516. doi:10.1257/aer.98.4.1476.

Eggertsson, Gauti B., and Benjamin Pugsley. "The Mistake of 1937: A General Equilibrium Analysis." Monetary and Economic Studies 24, nos. S-1 (December 2006): 151-90.

Eichengreen, Barry. "The U.S. Capital Market and Foreign Lending, 1920–1955." In Developing Country Debt and Economic Performance: The International Financial System, by Susan Margaret Collins and Jeffrey Sachs, 107-56. Vol. 1. Chicago: University of Chicago Press, 1989. Previously published as "Til Debt Do Us Part: The U.S. Capital Market and Foreign Lending, 1920-1955." NBER Working Paper W2394. http://www.nber.org/chapters/c8988.

"FDR: From Budget Balancer to Keynesian, A President's Evolving Approach to Fiscal Policy in Times of Crisis." Franklin D. Roosevelt Presidential Library and Museum. http://www.fdrlibrary.marist.edu/aboutfdr/budget.html.

Federal Reserve Board. Tenth Annual Report of the Federal Reserve Board: Covering Operations for the Year 1923. Washington: Government Printing Office, 1924. Accessed November 23, 2014. https://fraser.stlouisfed.org/docs/publications/arfr/1920s/arfr_1923.pdf.

Fisher, Irving. Booms and Depressions: Some First Principles. New York: Adelphi, 1932.

———. "The Debt-Deflation Theory of Great Depressions." Econometrica 1, no. 4 (October 1933): 337-57. DOI:10.2307/1907327.

———. "Dollar Stabilization." In Encyclopedia Britannica, 852-53. Vol. XXX. http://www.econlib.org/library/Essays/fshEnc1.html.

———. "Mathematical Investigations in the Theory of Value and Prices." Transactions of the Connecticut Academy of Arts and Sciences 9 (1892): 1-124.

———. "Our Unstable Dollar and the So-Called Business Cycle." Journal of the American Statistical Association 20, no. 150 (June 1925): 179-202. doi:10.2307/2277113.

———. "Stabilizing Price Levels." The New York Times, September 2, 1923, sec. XX, 10.

———. "Why Has the Doctrine of Laissez Faire Been Abandoned?" Science, n.s., 25, no. 627 (January 4, 1907): 18-27. http://www.jstor.org/stable/1633692.

Friedman, Milton, Paul A. Samuelson, and Henry Wallich. "How the Slump Looks to Three Experts." Newsweek, May 25, 1970, 78-79. Accessed November 23, 2014. http://hoohila.stanford.edu/friedman/newsweek.php.

Friedman, Milton, and Anna Jacobson Schwartz. A Monetary History of the United States 1867-1960. 9th ed. Princeton: Princeton University Press, 1993.

Gordon, Robert J., and Robert Krenn. "New Gordon-Krenn quarterly and monthly data set for 1913-54." Unpublished raw data, Northwestern University, n.d. Accessed March 30, 2015. http://faculty-web.at.northwestern.edu/economics/Gordon/researchhome.html.

Hearings Before the Banking, Housing, and Urban Affairs (2009) (statement of Lee E. Ohanian). Accessed January 25, 2015. http://www.banking.senate.gov/public/index.cfm?FuseAction=Files.View&FileStore_id=6cce4fbb-e7cd-4699-8892-9c5d1285e871.

Hemingway, Ernest. "Who Murdered the Vets?" The New Masses, September 17, 1935, 9-10. Accessed March 10, 2015. http://www.unz.org/Pub/NewMasses-1935sep17-00009.

Hobsbawm, E. J. Industry and Empire: The Birth of the Industrial Revolution. Edited by Chris Wrigley. New York: New Press, 1999. Originally published as Industry and Empire: An Economic History of Britain Since 1750 (London: Weidenfeld & Nicolson, 1968).

Jones & Laughlin Steel Corp. v. NLRB, 301 U.S. (1937). Accessed January 16, 2015. https://supreme.justia.com/cases/federal/us/301/1/case.html.

Kahn, Richard. "The Relation of Home Investment to Unemployment." The Economic Journal 41, no. 162 (June 1931): 173-98.

Keynes, John Maynard. "Chapter 24: Concluding Notes on the Social Philosophy towards Which the General Theory Might Lead." In The General Theory of Employment, Interest, and Money.

———. "The Great Slump of 1930." The Nation and Athenaeum 48 (December 20, 1930): 402.

———. "The Great Slump of 1930 II." The Nation and Athenaeum 48 (December 27, 1930): 427-28.

———. A Tract on Monetary Reform. 1923. Reprint, London: Macmillan, 1924.

Kindleberger, Charles Poor. The World in Depression, 1929-1939. Berkeley: University of California Press, 1973.

May, Dean L. From New Deal to New Economics: The Liberal Response to the Recession. Edited by Frank Freidel. Modern American History. New York: Garland Publishing, 1981.

Mehrotra, Ajay K. "Edwin R.A. Seligman and the Beginnings of the U.S. Income Tax." Tax Notes, November 14, 2005, 933-50.

Nasar, Sylvia. Grand Pursuit: The Story of Economic Genius. New York: Simon & Schuster, 2011.

NBER. The End of the Great Depression 1939-41: Policy Contributions and Fiscal Multipliers. By Robert J. Gordon and Robert Krenn. Working Paper no. 16380. 2010. Accessed March 30, 2015. doi:10.3386/w16380.

The New York Times. "Bonus Bill Becomes Law." January 28, 1936, Late City edition, 1. Accessed March 8, 2015. http://timesmachine.nytimes.com/timesmachine/1936/01/28/87903226.html?pageNumber=1.

The New York Times. "Both Coasts Threatened." September 3, 1935, Late City edition, 1. Accessed March 8, 2015. http://timesmachine.nytimes.com/timesmachine/1935/09/03/issue.html.

The New York Times. "Fisher Sees Stocks Permanently High." October 16, 1929, 8.

The New York Times. "Link Bonus Issue to Florida Deaths." September 15, 1935, Late City edition, N6. Accessed March 8, 2015. http://timesmachine.nytimes.com/timesmachine/1935/09/15/93707816.html?pageNumber=99.

The New York Times. "The Stock Market." October 20, 1937, Late City edition, 22. Accessed March 8, 2015. http://timesmachine.nytimes.com/timesmachine/1937/10/20/103216107.html?pageNumber=22.

The New York Times. "Veteran's Camp Wrecked by Storm." September 4, 1935, Late City edition, 1. Accessed March 8, 2015. http://timesmachine.nytimes.com/timesmachine/1935/09/04/93481928.html.

The New York Times. "Veterans Lead Fatalities. Only 11 of 192 Reported as Left Alive in One Florida Camp." September 5, 1935, Late City edition, 1. Accessed March 8, 2015. http://timesmachine.nytimes.com/timesmachine/1935/09/05/93482496.html?pageNumber=1.

Office of the Secretary of the Senate, Presidential Vetoes, 1789-1988, S. Doc. No. 102-12 (1992). Accessed March 8, 2015. http://www.senate.gov/reference/resources/pdf/presvetoes17891988.pdf.

"131 'I Pledge You—I Pledge Myself to a New Deal for the American People.' the Governor Accepts the Nomination for the Presidency, Chicago, Ill. July 2, 1932." In The Genesis of the New Deal, 1928-1932, 647-58. Vol. 1 of The Public Papers and Addresses of Franklin D. Roosevelt. New York: Random House, 1938.

Papadimitriou, Dimitri B., and Greg Hannsgen. Lessons from the New Deal: Did the New Deal Prolong or Worsen the Great Depression? Working Paper no. 581. Annandale-on-Hudson, NY: Levy Economics Institute of Bard College, 2009.

Personal Memo. October 19, 1937. Volume 92: October 12-October 19, 1937; Page 229. The Diaries of Henry Morgenthau, Jr. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

"Press Conference #425-15." January 14, 1938. Press Conferences of President Franklin D. Roosevelt, 1933-1945. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

"Press Conference #434." February 15, 1938. Press Conferences of President Franklin D. Roosevelt, 1933-1945. Franklin D. Roosevelt Presidential Library & Museum.

Press Conference #401-1. October 8, 1937. Press Conferences of President Franklin D. Roosevelt, 1933-1945. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

"Press Conference #405-5." October 22, 1937. Press Conferences of President Franklin D. Roosevelt, 1933-1945. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

"Press Conference #409-7." November 9, 1937. Press Conferences of President Franklin D. Roosevelt, 1933-1945. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

"Press Conference #415-8." December 10, 1937. Press Conferences of President Franklin D. Roosevelt, 1933-1945. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

"Press Conference #416-4." December 14, 1937. Press Conferences of President Franklin D. Roosevelt, 1933-1945. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

"Press Conference #357." April 2, 1937. Page 239. Press Conferences of President Franklin D. Roosevelt, 1933-1945. Franklin D. Roosevelt Presidential Library & Museum.

Romer, Christina D. "Lessons from the Great Depression for Economic Recovery in 2009." Speech presented at Brookings Institution, Washington D.C., March 9, 2009. Accessed April 21, 2015. http://www.brookings.edu/~/media/events/2009/3/09-lessons/0309_lessons_romer.pdf.

———. "Spurious Volatility in Historical Unemployment Data." Journal of Political Economy 94, no. 1 (February 1986): 1-37. http://www.jstor.org/stable/1831958.

———. "What Ended the Great Depression?" The Journal of Economic History 52, no. 4 (December 1992): 757-84.

Roose, Kenneth D. The Economics of Recession and Revival: An Interpretation of 1937-38. Yale Studies in Economics 2. New Haven: Yale University Press, 1954.

———. "The Recession of 1937-38." Journal of Political Economy 56, no. 3 (June 1948): 239-48. Accessed January 26, 2015. http://www.jstor.org/stable/1825772.

———. "The Role of Net Government Contribution to Income in the Recession and Revival of 1937-38." The Journal of Finance 6, no. 1 (March 1951): 1-18. DOI:10.1111/j.1540-6261.1951.tb04437.x.

Roosevelt, Franklin D. "Annual Budget Message to Congress." Address, January 7, 1937. The American Presidency Project. http://www.presidency.ucsb.edu/ws/?pid=15337.

———. "Annual Message to Congress." Address, January 6, 1937. The American Presidency Project. http://www.presidency.ucsb.edu/ws/?pid=15336.

———. "Fireside Chat on Banking." Speech, March 12, 1933. The American Presidency Project. http://www.presidency.ucsb.edu/ws/?pid=14540.

———. "Message to Congress Recommending Legislation, November 5, 1937." The American Presidency Project. http://www.presidency.ucsb.edu/ws/?pid=15496.

———. "Proclamation 2040 - Bank Holiday." The American Presidency Project. http://www.presidency.ucsb.edu/ws/?pid=14485.

———. "Proclamation 2039 - Declaring Bank Holiday." The American Presidency Project. http://www.presidency.ucsb.edu/ws/?pid=14661.

———. "60 - Message to Congress on Appropriations for Work Relief for 1938. April 20, 1937." The American Presidency Project. Accessed March 19, 2015. http://www.presidency.ucsb.edu/ws/?pid=15393.

———. "Statement Summarizing the 1938 Budget, October 19, 1937." The American Presidency Project. Accessed March 22, 2015. http://www.presidency.ucsb.edu/ws/?pid=15486.

Schumpeter, Joseph A. "Chapter 5.4: Unemployment and the ‘State of the Poor’." In History of Economic Analysis, 258-63. Edited by Elizabeth B. Schumpeter. New York: Oxford University Press, 1954.

Shlaes, Amity. The Forgotten Man: A New History of the Great Depression. New York: Harper Collins, 2007.

Smith, Adam. An Inquiry into the Nature and Causes of the Wealth of Nations. Edited by Edwin Cannan. 5th ed. 1776. Reprint, London: Methuen & Co., 1904. http://www.econlib.org/library/Smith/smWN.html.

Telser, Lester G. "Higher Member Bank Reserve Ratios in 1936 and 1937 Did Not Cause the Relapse into Depression." Journal of Post Keynesian Economics 24, no. 2 (Winter 2001-2): 205-16.

———. "The Veterans' Bonus of 1936." Journal of Post Keynesian Economics 26, no. 2 (Winter 2003-4): 227-43.

Three Parts of Speech as Decided Upon, 10/28/37. Volume 95: November 10, 1937; Page 261. Diaries of Henry Morgenthau, Jr. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

The Times-Picayune (New Orleans, LA). "A Cloud That's Dragonish." January 8, 1937, 12.

The Times-Picayune (New Orleans, LA). "Industry Pushes up after Holiday Lull; Steel Leads." January 11, 1937, 18.

Transcript of Call between Morgenthau and Burgess. October 19, 1937. Volume 92: October 12-October 19, 1937; Page 222. The Diaries of Henry Morgenthau, Jr. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

Transcript of Phone Call between Morgenthau and FDR. October 20, 1937. Volume 93: October 20-October 31, 1937; Page 21. The Diaries of Henry Morgenthau, Jr. Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

United States Senate Special Committee on the Termination of the National Emergency. Emergency Powers Statutes: Provisions of Federal Law Now in Effect Delegating to the Executive Extraordinary Authority in Time of National Emergency. Report no. 93-549. Washington: Government Printing Office, 1973.

U.S. Department of Commerce Bureau of Foreign and Domestic Commerce. Statistical Abstract of the United States 1934. Washington: Government Printing Office, 1934. Accessed November 23, 2014. https://fraser.stlouisfed.org/docs/publications/stat_abstract/1930s/sa_1934.pdf.

Velde, François. "The Recession of 1937—A Cautionary Tale." Economic Perspectives 33, no. 4 (2009): 16-37.

Wood, Howard. "Stocks Crash to New Lows; Selling Swamps Market; Blame Federal Policies." Chicago Daily Tribune, October 19, 1937, Final edition, 1. Accessed March 10, 2015. http://archives.chicagotribune.com/1937/10/19/page/1/article/stocks-crash-to-new-lows.

World War Adjusted Compensation Act, ch. 157, 43 Stat. 121-131 (May 19, 1924). Accessed March 7, 2015. http://www.loc.gov/law/help/statutes-at-large/68th-congress/c68.pdf.

Yale University. "Past Presidents." Office of the President. Accessed December 7, 2014. http://president.yale.edu/past-presidents.

Endnotes

- Real GDP is a measure of economic output that is adjusted for price changes at each observation year. The values in Figure 1 are in terms of 1937 dollars.

- The data was made relative to the pre-Depression peak in industrial production, which occurred in the year 1929. In other words, the data was adjusted so that the 1929 peak equals 100%.

- Barber, From New Era to New Deal, 118.

- Ibid.,195.

- Ibid., 36.

- Kindleberger, The World in Depression, 56.

- Eichengreen, "The U.S. Capital Market," in Developing Country Debt and Economic, 1:122.

- Ibid.

- Ibid., 1:124.

- Barber, From New Era to New Deal, 72.

- Ibid., 73.

- U.S. Department of Commerce Bureau of Foreign and Domestic Commerce, Statistical Abstract of the United, 279.

- According to data obtained from the BEA, GDP in 1929 was $104.6 Billion and 2014 Q2 GDP is $16,010 Billion.

- Federal Reserve Board, Tenth Annual Report of the Federal, 34.

- Friedman and Schwartz, A Monetary History of the United, 254.

- Fisher Sees Stocks Permanently High,” The New York Times, October 16, 1929.

- Friedman, Samuelson, and Wallich, "How the Slump Looks to Three Experts," Newsweek, May 25, 1970.

- The money supply refers to money available for use and circulating in the economy. Varying standardized measures of the money supply exist, from most liquid measurement of money to least liquid.

- Friedman and Schwartz, A Monetary History of the United, 300.

- Ibid., 308.

- Ibid., 310.

- Edsforth, The New Deal: America's, 43.

- Ibid., 40.

- Friedman and Schwartz, A Monetary History of the United, 313.

- Ibid., 315-317.

- Ibid., 322.

- Ibid., Table A-1, 713.

- Black, Franklin Delano Roosevelt: Champion, 269.

- Roosevelt, "Proclamation 2039 - Declaring," The American Presidency Project.

- Roosevelt, "Proclamation 2040 - Bank," The American Presidency Project.

- United States Senate Special Committee on the Termination of the National Emergency, Emergency Powers Statutes: Provisions, 4-5.

- Roosevelt, "Fireside Chat on Banking," The American Presidency Project.

- Friedman and Schwartz, A Monetary History of the United, 311.

- Ibid., 312.

- Hobsbawm, Industry and Empire: The Birth, 190.

- Say’s Law is the defunct notion that production is itself the source of demand. An individual producer is paid for their services and that payment is used to purchase other goods.

- Keynes, "The Great Slump of 1930," 402.

- Nasar, Grand Pursuit: The Story, 323.

- "131 'I Pledge You—I," in The Genesis of the New Deal, 651.

- Ibid., 652.

- Ibid., 658.

- Schumpeter, "Unemployment and the ‘State of the Poor’," inHistory of Economic Analysis.

- A concise history of Progressive-Era economic policy reform efforts, specifically that of public finance, is provided in: Ajay K. Mehrotra, "Edwin R.A. Seligman and the Beginnings of the U.S. Income Tax,"Tax Notes, November 14, 2005.

- Keynes, "The Great Slump of 1930," 402.

- Ibid.

- Keynes, "The Great Slump of 1930, II" 428.

- Smith, An Inquiry into the Nature, IV.2.9.

- Nasar, Grand Pursuit: The Story, 149.

- "Past Presidents," Office of the President.

- Nasar, Grand Pursuit: The Story, 150.

- Ibid., 151.

- Ibid.

- Fisher, "Why Has the Doctrine," 27.

- Nasar, Grand Pursuit: The Story, 283.

- Keynes, A Tract on Monetary, 187.

- Fisher, "Dollar Stabilization.," in Encyclopedia Britannica, XXX.

- Friedman and Schwartz, A Monetary History of the United, 206.

- Ibid., 226-233.

- Romer, "Spurious Volatility in Historical," 31.

- Nasar, Grand Pursuit: The Story, 301.

- Irving Fisher, "Stabilizing Price Levels," The New York Times, September 2, 1923.

- Fisher, "Our Unstable Dollar and the So-Called," 201.

- Fisher, "The Debt-Deflation Theory of Great," 342.

- Fisher, Booms and Depressions: Some, 142.

- Allen, "Irving Fisher, F. D. R., and the Great," 576.

- Ibid., 562.

- Ibid., 580-581.

- Ibid., 577.

- Ibid., 565.

- Ibid., 565.

- Fisher’s latter comment is in regards to the 17% increase in nominal wages between November 1936 and November 1937, as measured by the Bureau of Labor Statistics and the National Industrial Conference Board (Velde, "The Recession of 1937—A," 29).

- Nasar, Grand Pursuit: The Story, 319.

- Ibid., 326.

- Ibid., 324.

- Richard Kahn, "The Relation of Home Investment to Unemployment," The Economic Journal 41, no. 162 (June 1931)

- "FDR: From Budget Balancer to Keynesian,” Franklin D. Roosevelt Presidential Library and Museum, http://www.fdrlibrary.marist.edu/aboutfdr/budget.html.

- Kindleberger, The World in Depression, 262.

- An act to provide adjusted compensation for veterans of the World War, and for other purposes., H.R. 10874, 67th Cong., 2d Sess. (1922). Office of the Secretary of the Senate, Presidential Vetoes, 1789-1988, S. Doc. No. 102-12 (1992), 225.

- Ibid., 228.

- World War Adjusted Compensation Act, ch. 157, 43 Stat. 121-131 (May 19, 1924).

- "Both Coasts Threatened," The New York Times, September 3, 1935.

- "Veteran's Camp Wrecked by Storm," The New York Times, September 4, 1935.

- "Veterans Lead Fatalities,” The New York Times, September 5, 1935.

- "Link Bonus Issue to Florida Deaths," The New York Times, September 15, 1935.

- Nancy Baker, "Abel Meeropol (a.k.a. Lewis Allan): Political Commentator and Social Conscience," American Music 20, no. 1 (Spring 2002): 45.

- Hemingway, "Who Murdered the Vets?," The New Masses, September 17, 1935.

- Adjusted Compensation Payment Act, ch. 32, 49 Stat. 1099-1102 (Jan. 27, 1936).

- "Bonus Bill Becomes Law," The New York Times, January 28, 1936.

- For a detailed analysis of the Soldier’s Bonus expansionary effect, consult: Telser, "The Veterans' Bonus of 1936,"Journal of Post Keynesian Economics26, no. 2 (Winter 2003-4).

- Eggertsson and Pugsley, "The Mistake of 1937," 174.

- Roosevelt, "Annual Message to Congress, January 6, 1937,” The American Presidency Project.

- Roosevelt, "Annual Budget Message to Congress," The American Presidency Project.

- "Press Conference #357," April 2, 1937, Page 239, Press Conferences of President Franklin D. Roosevelt, 1933-1945, Franklin D. Roosevelt Presidential Library & Museum.

- Data source: Board of Governors of the Federal Reserve System (US), Industrial Production Index[INDPRO], retrieved from FRED, Federal Reserve Bank of St. Louis.

- "The Stock Market," The New York Times, October 20, 1937.

- Howard Wood, "Stocks Crash to New Lows,” Chicago Daily Tribune, October 19, 1937.

- "The Stock Market," The New York Times, October 20, 1937.

- Personal Memo, October 19, 1937, Volume 92: October 12-October 19, 1937; Page 229, The Diaries of Henry Morgenthau, Jr., Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

- Transcript of Call between Morgenthau and FDR. October 19, 1937, Volume 92: October 12-October 19, 1937; Page 230, The Diaries of Henry Morgenthau, Jr., Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

- Transcript of Call between Morgenthau and Burgess, October 19, 1937, Volume 92: October 12-October 19, 1937; Page 222, The Diaries of Henry Morgenthau, Jr., Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

- Transcript of Phone Call between Morgenthau and FDR, October 20, 1937, Volume 93: October 20-October 31, 1937; Page 21, The Diaries of Henry Morgenthau, Jr., Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

- Draft Letter to FDR, November 3, 1937, Volume 94: November 1-November 10, 1937; Page 47, The Diaries of Henry Morgenthau, Jr., Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

- Roosevelt, "60 - Message to Congress," The American Presidency Project.

- Press Conference #401-1.

- Press Conference #405-5.

- Roosevelt, "Statement Summarizing the 1938," The American Presidency Project.

- Press Conferences #409-7; #415-8; #416-4.

- Press Conference #425-15.

- "A Cloud That's Dragonish,"The Times-Picayune(New Orleans, LA), January 8, 1937, 12.

- "Industry Pushes up after Holiday Lull; Steel Leads,"The Times-Picayune(New Orleans, LA), January 11, 1937, 18.

- Rodney Dutcher, "Behind the Scenes in Washington,"The Brownsville Herald(Brownsville, TX), April 2, 1937,4.

- This small, local, newspaper featured during the same week at least two in-depth articles focused on analysis of policy, not only news: "Public Funds Will Control High Prices?,"The Brownsville Herald(Brownsville, TX), April 4, 1937,1-2. "Prices,"The Brownsville Herald(Brownsville, TX), April 2, 1937,1.

- Conference to Talk Over Plans, 9/13/37, Volume 95: November 10, 1937; Page 1, Diaries of Henry Morgenthau, Jr., Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

- Three Parts of Speech as Decided Upon, 10/28/37, Volume 95: November 10, 1937; Page 261, Diaries of Henry Morgenthau, Jr., Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

- Shlaes,The Forgotten Man: A New History, 341-342.

- Complete Set of Speech Drafts, Volume 97: November 10, 1937; Page 149, Diaries of Henry Morgenthau, Jr., Franklin D. Roosevelt Presidential Library & Museum, Hyde Park, NY.

- Ibid., 142.

- Ibid., 143.

- Roosevelt, "Message to Congress Recommending," The American Presidency Project.

- "Document 50: February 28, 1938, Letter with attachments, To: Keynes From: Roosevelt," in FDR's Response to Recession, ed. George McJimsey, vol. 26, Documentary History of the Franklin D. Roosevelt Presidency (University Publications of America, 2005), 307.

- Ibid., 312.

- Roose, "The Recession of 1937-38," 239.

- Roose, "The Role of Net Government," 1.

- Personal Income is income received by individuals, non-profit institutions, private trust funds, and private pension funds. It is the sum of wages, labor income, rental income, interest, dividends, and transfer payments. Source: National Income and Product Statistics of the United States 1929-46, US Dept. of Commerce, 1946, p. 53-54. Net Gvt. Contribution to Income is a breakdown of measured net decreasing (taxes, etc.) and increasing expenditures (social services, etc.). Figures include local, state, and federal contributions. Source: Deficit Spending and the National Income, Henry H. Villard, 1941, Appendix I p. 323.

- Roose, "The Role of Net Government," 4.

- Ibid., 240.

- Ibid., 6.

- Ibid., 14.

- Roose, The Economics of Recession, 6.

- "Radio Address." Under the auspices of the National Radio Forum, conducted by The Washington Evening Star, broadcast over the National Broadcasting Company Network, January 23, 1939, https://fraser.stlouisfed.org/title/?id=446#!7658, accessed on February 1, 2015.

- Friedman and Schwartz, A Monetary History of the United, 493.

- Ibid., 495.

- Cole and Ohanian, "New Deal Policies and the Persistence," 783.

- Ibid., 784.

- An Act to Diminish the Causes of Labor Disputes Burdening or Obstructing Interstate and Foreign Commerce, to Create a National Labor Relations Board, and for Other Purposes., Pub. L. No. 74-198, Stat. (July 5, 1935).

- Jones & Laughlin Steel Corp. v. NLRB, 301 U.S. (1937).

- Cole and Ohanian, "New Deal Policies and the Persistence," 788.

- Velde, "The Recession of 1937—A," 30.

- Testimony Before the US Senate Committee on Banking, Housing, and Urban Affairs (2009) (statement of Lee E. Ohanian).

- Velde, "The Recession of 1937—A," 31.

- Romer, "What Ended the Great Depression?," 763.

- Overwhelmingly, the NLRA has been discounted as a contributing factor to the Recession. For a detailed review of the existing literature, specifically that related to the NLRA, consult: Papadimitriou and Hannsgen,Lessons from the New Deal: Did the New Deal Prolong or Worsen the Great Depression?

- Gauti B. Eggertsson and Benjamin Pugsley, "The Mistake of 1937: A General Equilibrium Analysis," Monetary and Economic Studies 24, nos. S-1 (December 2006): 153.

- Ibid., 151.

- Ibid., 154.

- Gauti B. Eggertsson, Great Expectations and the End of the Depression, staff report no. 234 (Federal Reserve Bank of New York, 2005). Published as "Great Expectations and the End of the Depression," American Economic Review 98, no. 4 (September 2008).

- Eggertsson and Pugsley, "The Mistake of 1937," 174.

- Franklin D. Roosevelt, "Annual Message to Congress," address, January 6, 1937, The American Presidency Project, http://www.presidency.ucsb.edu/ws/?pid=15336.

- Eggertsson and Pugsley, "The Mistake of 1937," 175, Table 3.

- Ibid., 182.

- Ibid., 180.

- "Press Conference #434," February 15, 1938, Press Conferences of President Franklin D. Roosevelt, 1933-1945, Franklin D. Roosevelt Presidential Library & Museum.

- Friedman and Schwartz, A Monetary History of the United, 496.

- Arthur F. Burns and Wesley C. Mitchell, Measuring Business Cycles, Studies in Business Cycles 2 (New York: National Bureau of Economic Research, 1946),88-89

- Roose, "The Role of Net Government," 10.

- Friedman and Schwartz, A Monetary History of the United, 517.

- Ibid., 515.

- Ibid., 518.

- Each concern listed on the memorandum is closely analyzed in A Monetary History, 523.

- Ibid., 520.

- Romer, "What Ended the Great," 758.

- Ibid.

- Ibid., 759.

- Ibid., 758.

- Romer, "Lessons from the Great Depression for Economic Recovery in 2009," speech presented at Brookings Institution, Washington D.C., March 9, 2009, 3.

- Brown, "Fiscal Policy in the 'Thirties," 863-866.

- Romer, "Lessons from the Great,” speech, 3.

- Ibid., 4.

- Velde, "The Recession of 1937—A," 34.

- Ibid., 25.

- Ibid., 26.

- Ibid.

- Cargill and Mayer, "The Effect of Changes," 417-418.

- Ibid., 430.

- Ibid., 430-431.

- January 1935 was chosen as the starting point because the economy was, by that time, in steady recovery. This allows for an analysis untarnished by the shocks that occurred early during the Depression. December 1938 was chosen as the end point in order to exclude from the analysis any possible impacts of pre-WWII German aggression, especially that caused by the Occupation of Czechoslovakia in March 1939.

- Board of Governors of the Federal Reserve System (US), Industrial Production Index [INDPRO], retrieved from FRED, Federal Reserve Bank of St. Louis https://research.stlouisfed.org/fred2/series/INDPRO/

- NBER, The End of the Great Depression 1939-41: Policy Contributions and Fiscal Multipliers, by Robert J. Gordon and Robert Krenn, working paper no. 16380, 2010. Robert J. Gordon and Robert Krenn, "New Gordon-Krenn quarterly and monthly data set for 1913-54" (unpublished raw data), accessed March 30, 2015, http://faculty-web.at.northwestern.edu/economics/Gordon/researchhome.html.

- NBER, The End of the Great, 43. Gordon and Krenn provide more detailed information about the process, including the monthly independent interpolators used, in their appendix. (NBER, The End of the Great, 42-54).

- Gordon and Krenn explain the transformation of government spending: “A problem arises in this series because it includes not just G but also transfer payments, which are excluded when calculating GDP. The monthly interpolator series is distorted by particularly large transfer payments in scattered quarters. To find these quarters, we calculated the monthly log change in the interpolator, after changing the data to real terms and X11 s.a. Whenever a monthly change of +40 percent or more was followed by a monthly change of approximately the same amount with a negative sign, we replaced that “bulge” observation by the average of the preceding and succeeding months. These bulges occurred and were corrected for in 4 months: 1931:12, 1934:01, 1936:06, and 1937:06.” (NBER, The End of the Great, 46.)

- The wage and manhour datasets were individually re-indexed to January 1935 prior to their transformation.

- The assumption that monetary policy may have played a role in the recession hinges on the assumption that the money supply was impacted by the increased reserve requirements. Based on the related discussion presented in the previous chapter, both assumptions are made.

- NBER macrohistory datasets utilized: Total sum of excess and required reserves held, (series 14064); Percentage of total reserves held to reserves required (series 14086).

- Velde, "The Recession of 1937—A,"24.

- Velde’s Figure 8.C highlights the remarkably stark accumulation of excess reserves by central reserve city banks. (Velde, "The Recession of 1937—A,"24.)

- The monthly GDP deflator was obtained from the Gordon and Krenn dataset. See footnote 178.

- Real money supply excluding reserves was created by subtracting deflated total reserves (series 14064) from deflated money stock (series 14144a).

- A strong case has been made for the use of bank assets, not liabilities, as the measurement of bank holdings during the 1937 period. However, to examine closely the argument as made by Friedman, and due to the lack of reliable monthly asset-side data, the more traditional liability-side measurement is used. For a detailed study of the alternative asset-side measurement, one that highlights the shortcomings of liability-side measurements, consult: Telser, "Higher Member Bank Reserve Ratios in 1936 and 1937 Did Not Cause the Relapse into Depression,"Journal of Post Keynesian Economics.

- Model 4 was cleaned by removing, step by step, the most insignificant variable lags found in Model 2.Insignificant variables were removeduntil regression was narrowed to only significant regressors.

- G% of GDP during years examined averaged 15%.

- NBER, The End of the Great, 35.

- Keynes, "Chapter 24: Concluding Notes," in The General Theory of Employment.

Appendix

Tables

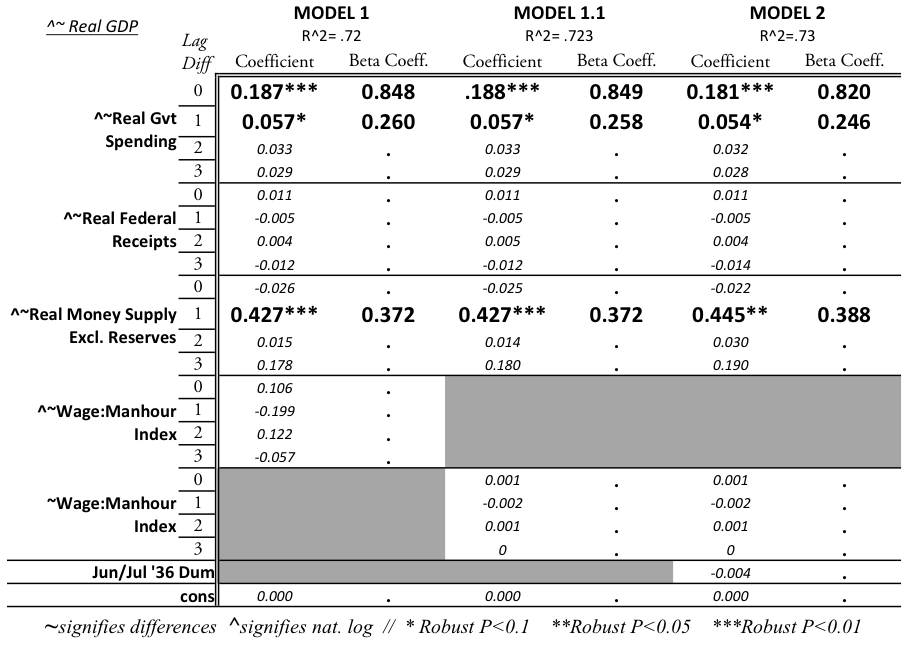

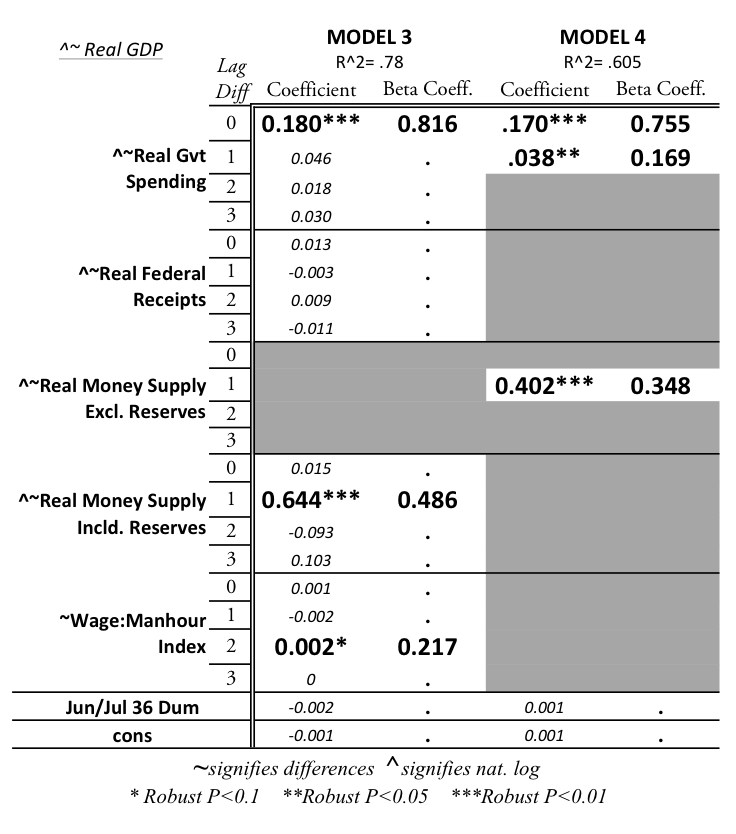

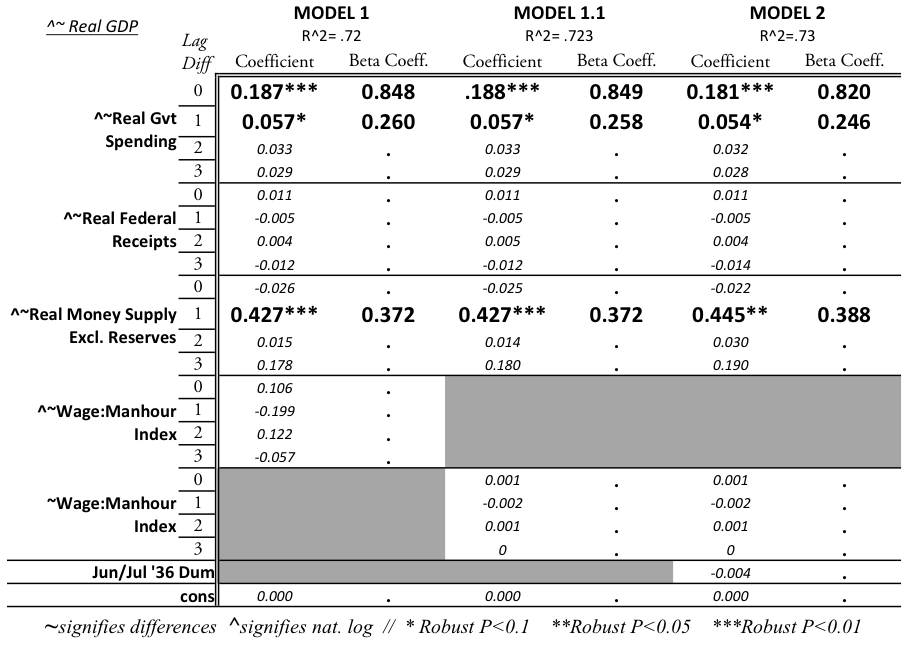

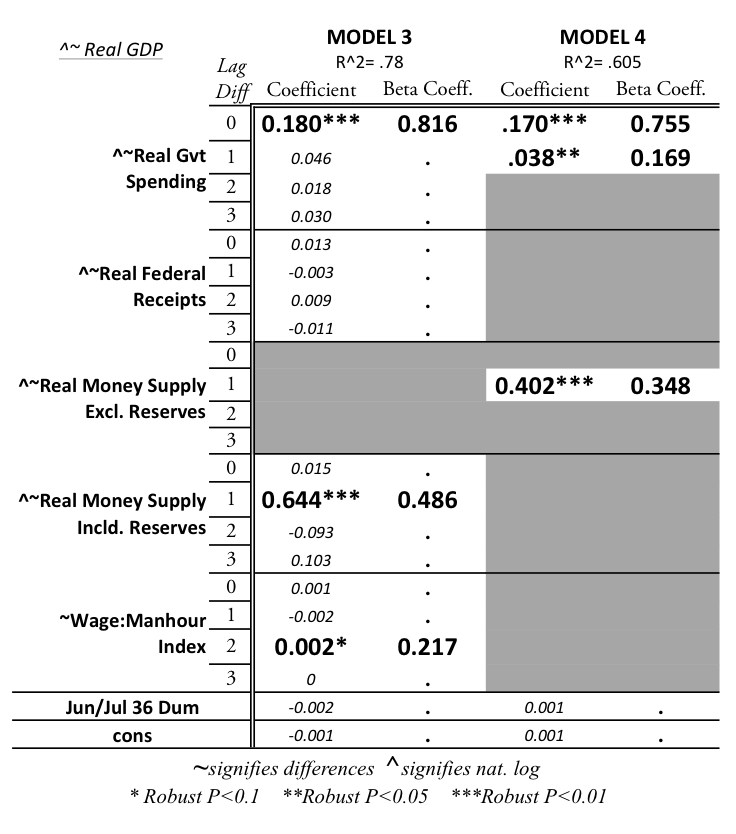

Table A-1

Table A-2

Table A-3

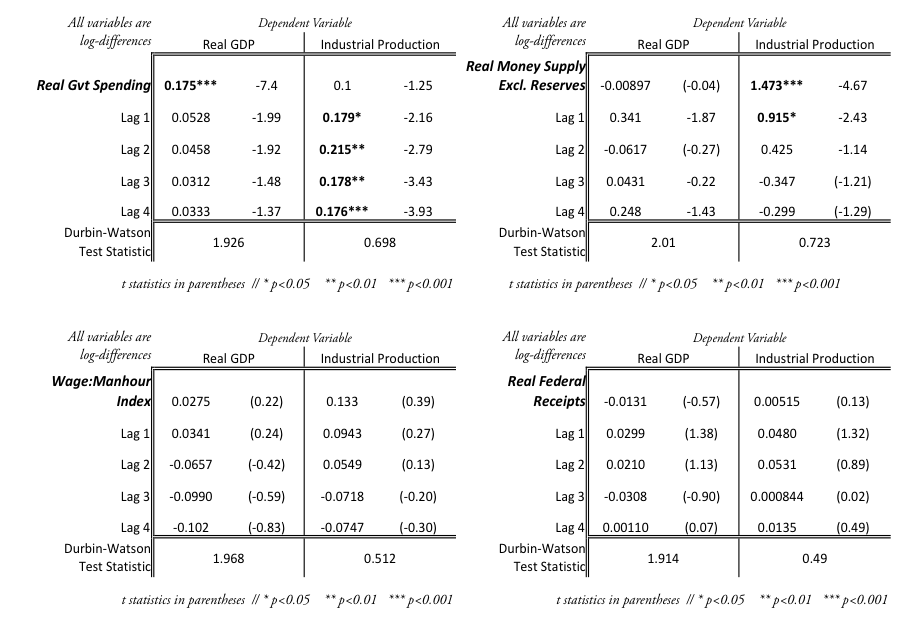

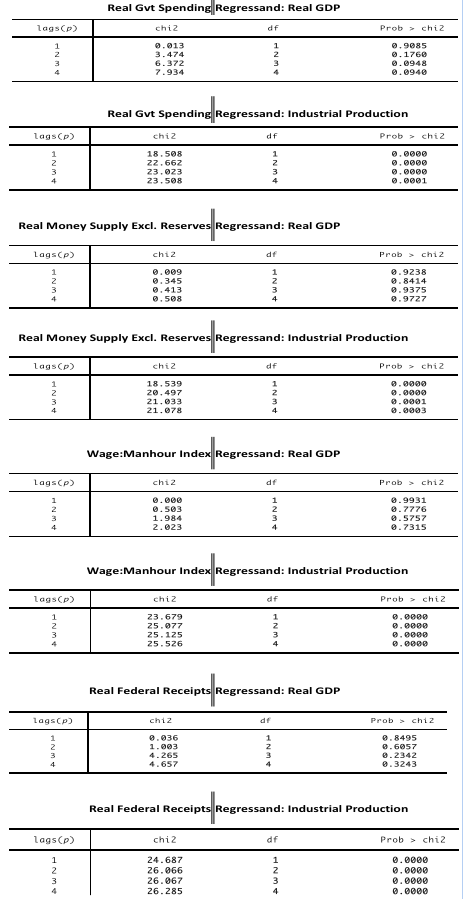

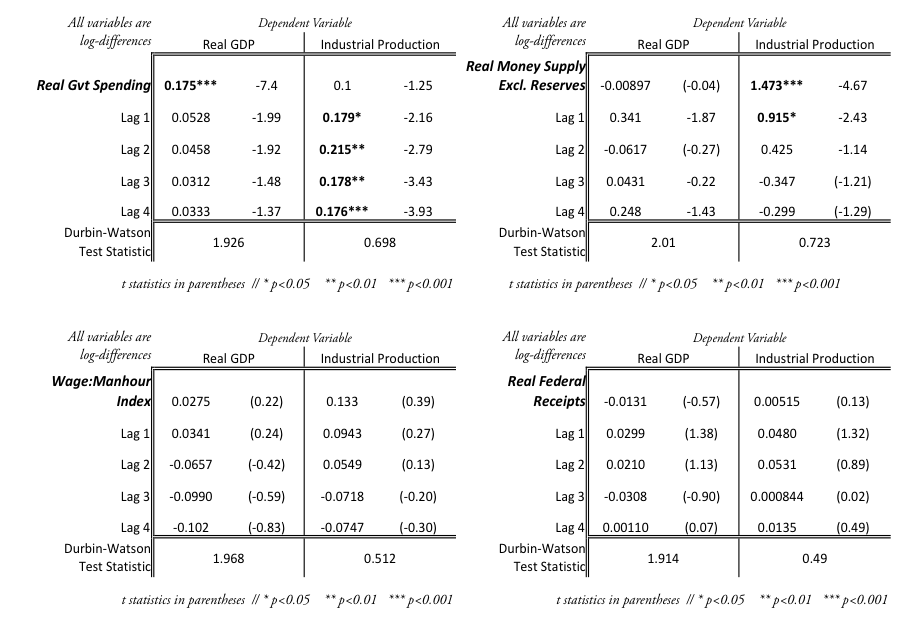

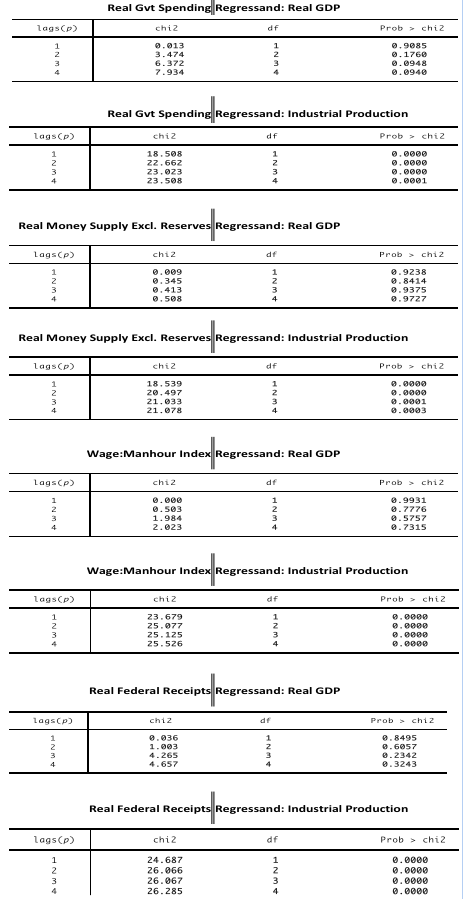

Table A-4. Simple regression of each independent variable on GDP or industrial production.

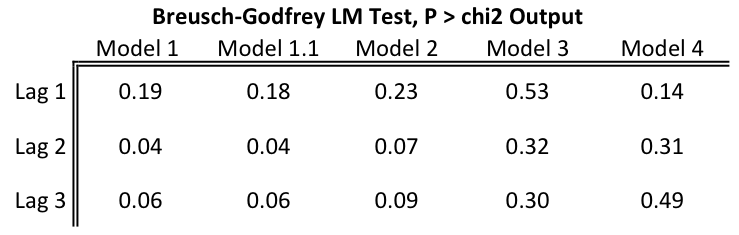

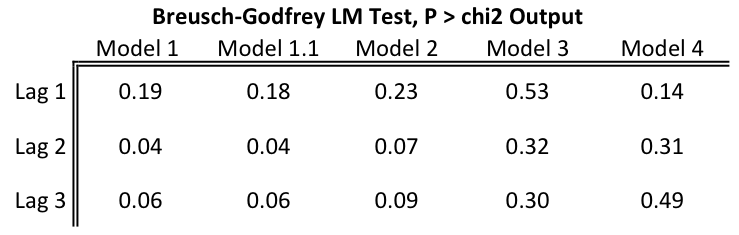

Table A-5. Breusch-Godfrey Test Results for Table A-4 regressions.

Figures

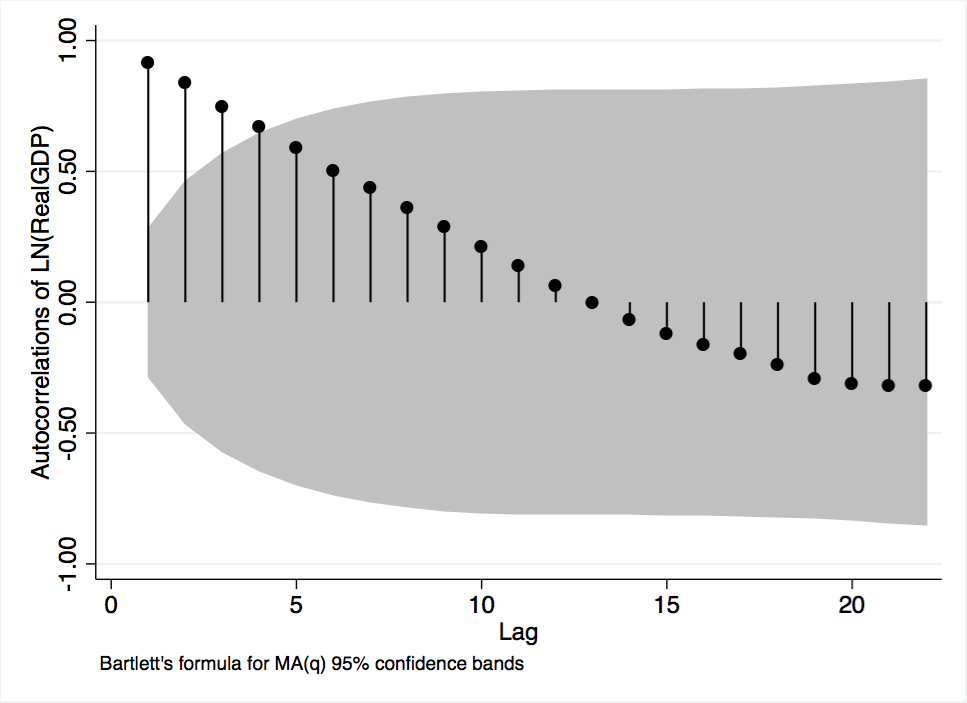

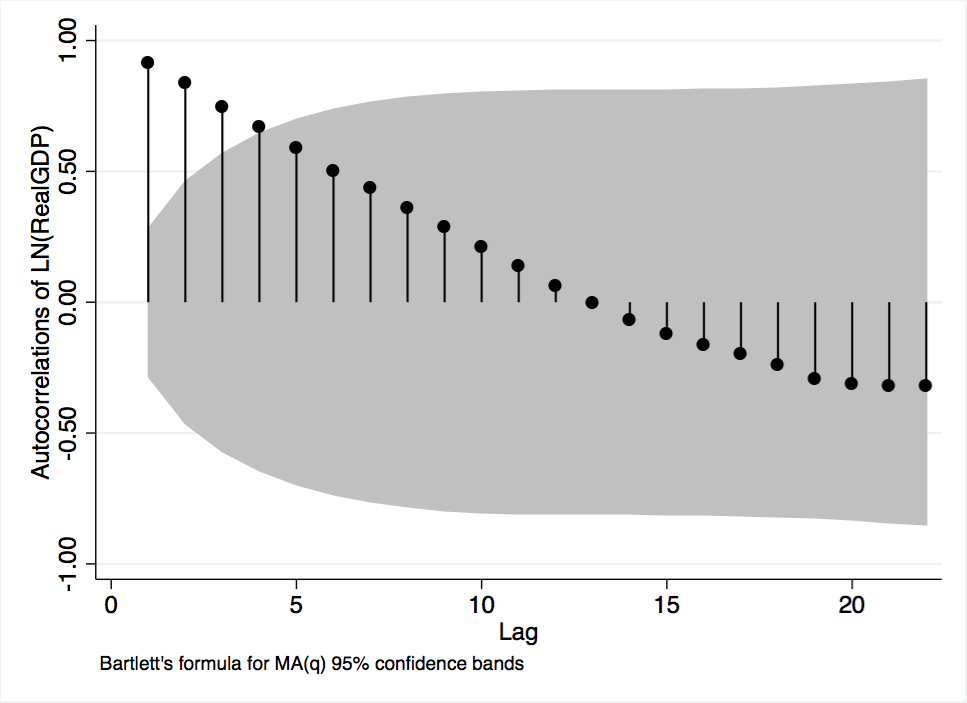

Figure A-1. Autocorrelation plot of GDP variable.

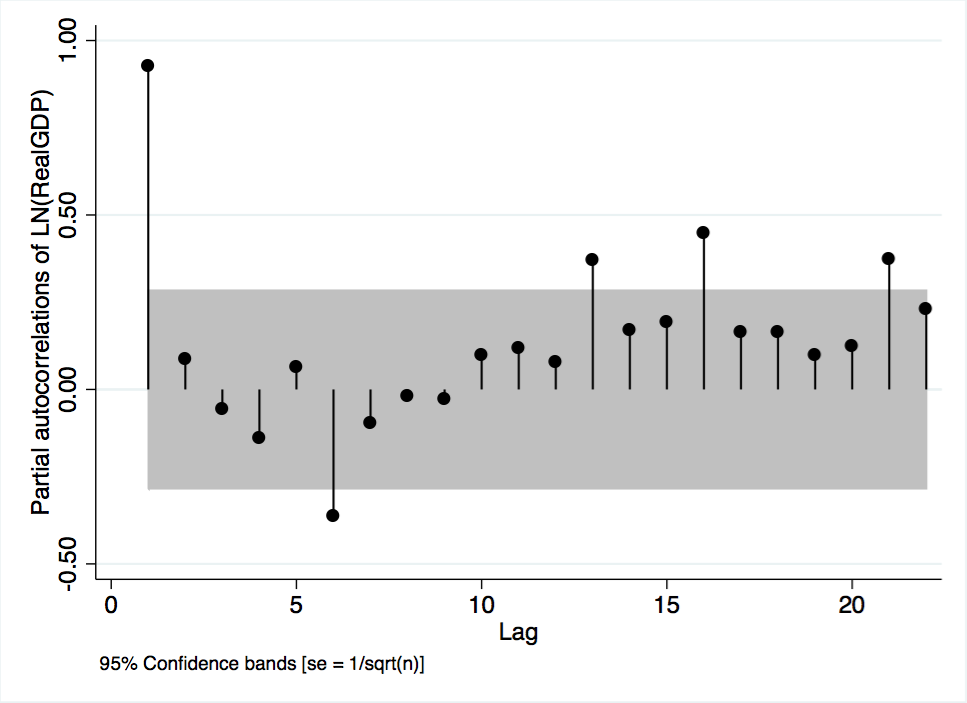

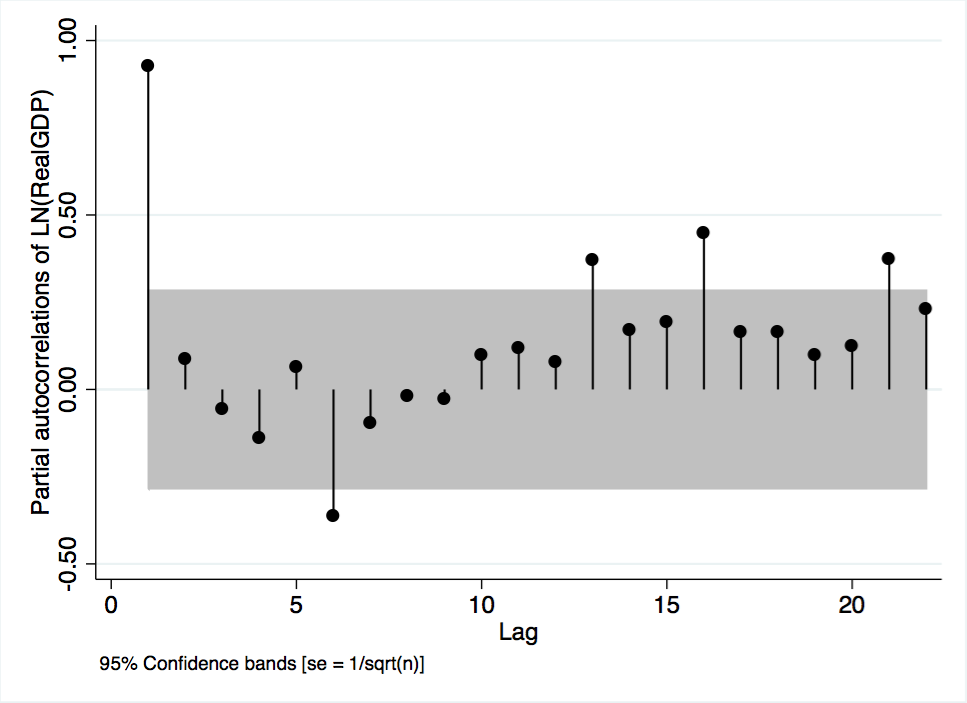

Figure A-2. Partial autocorrelation plot of GDP variable.

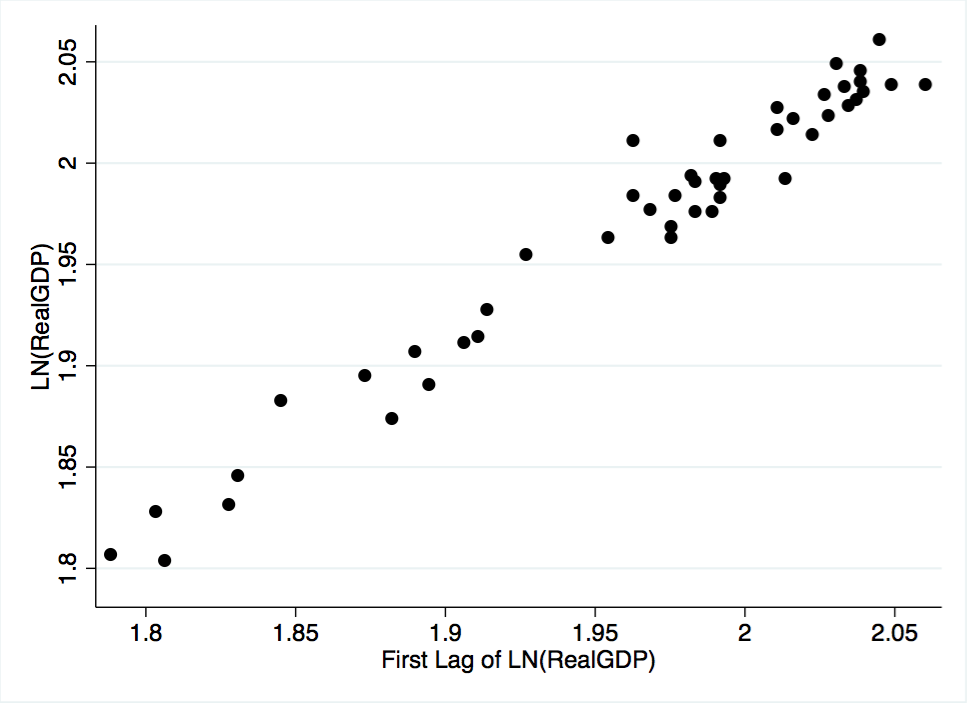

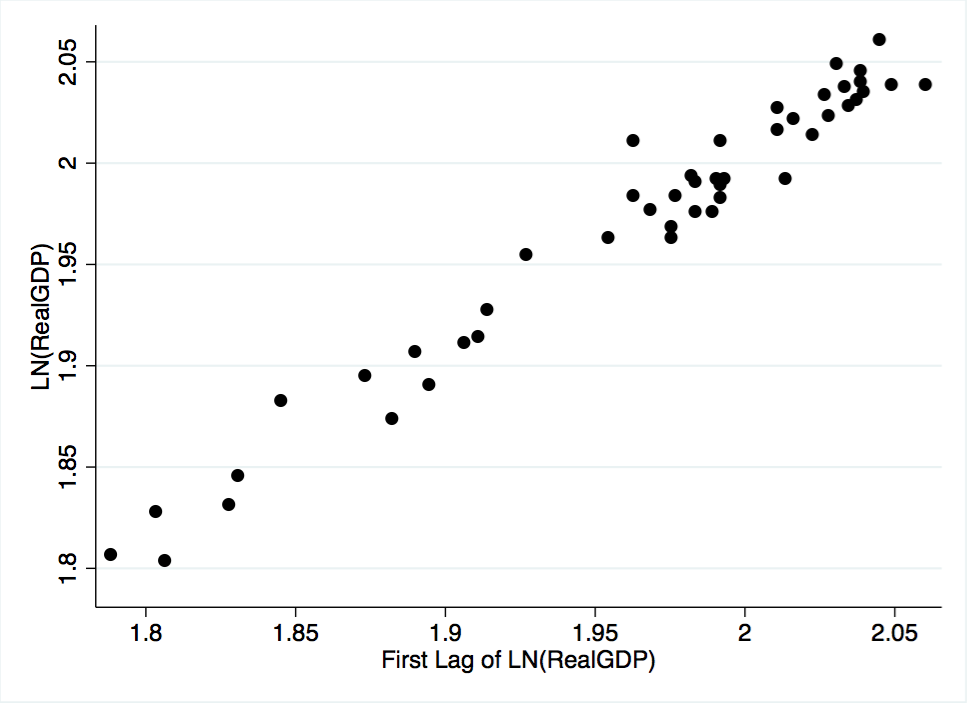

Figure A-3. Scatterplot of the GDP variable against its first lag.

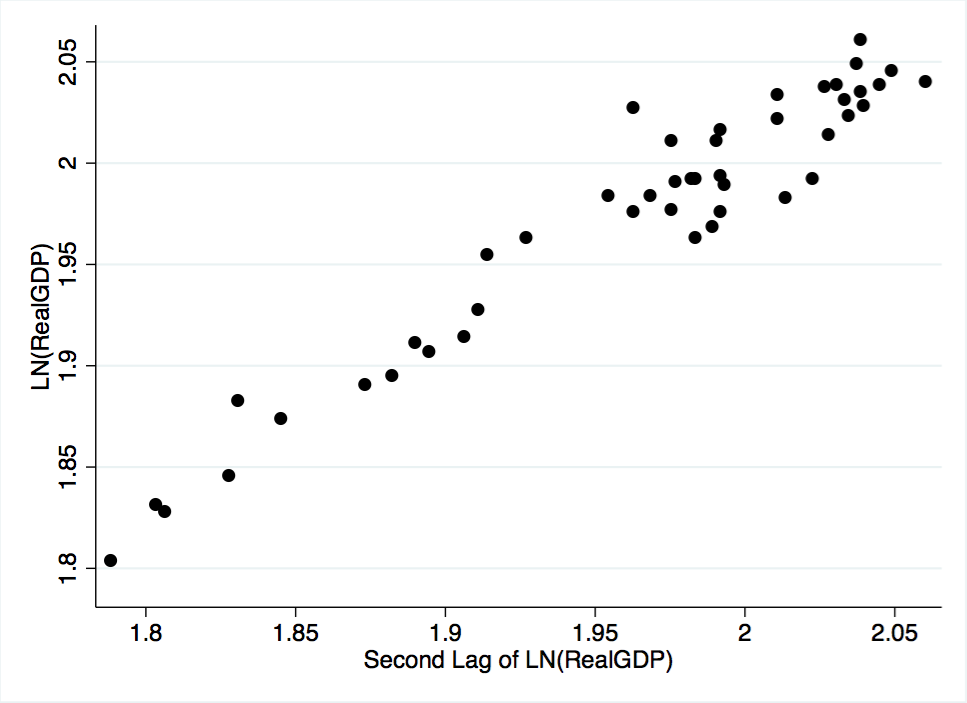

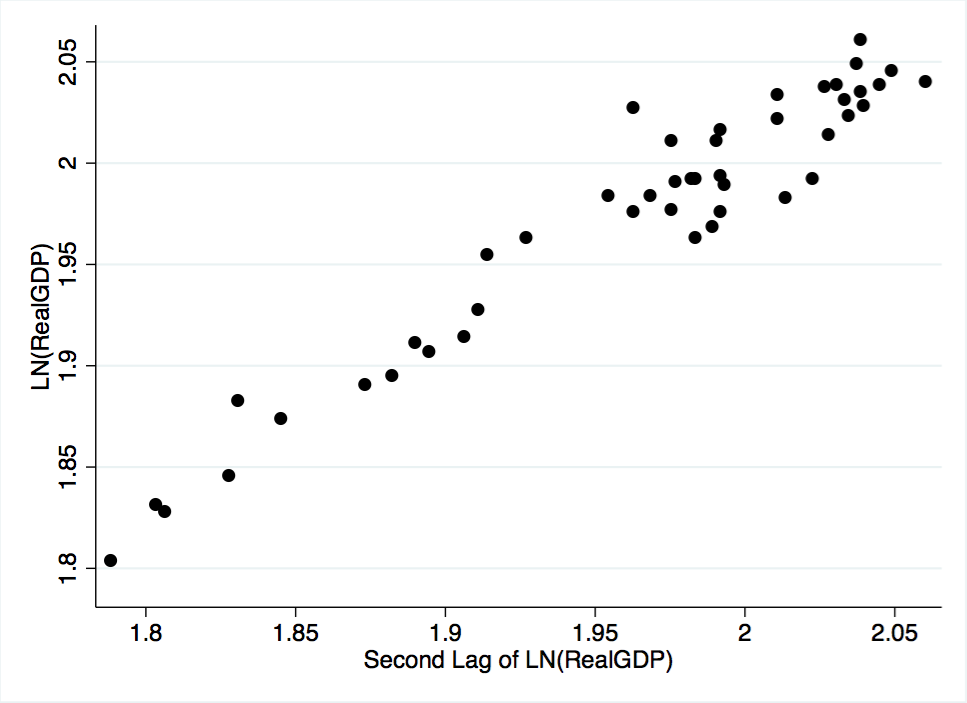

Figure A-4. Scatterplot of the GDP variable against its second lag.

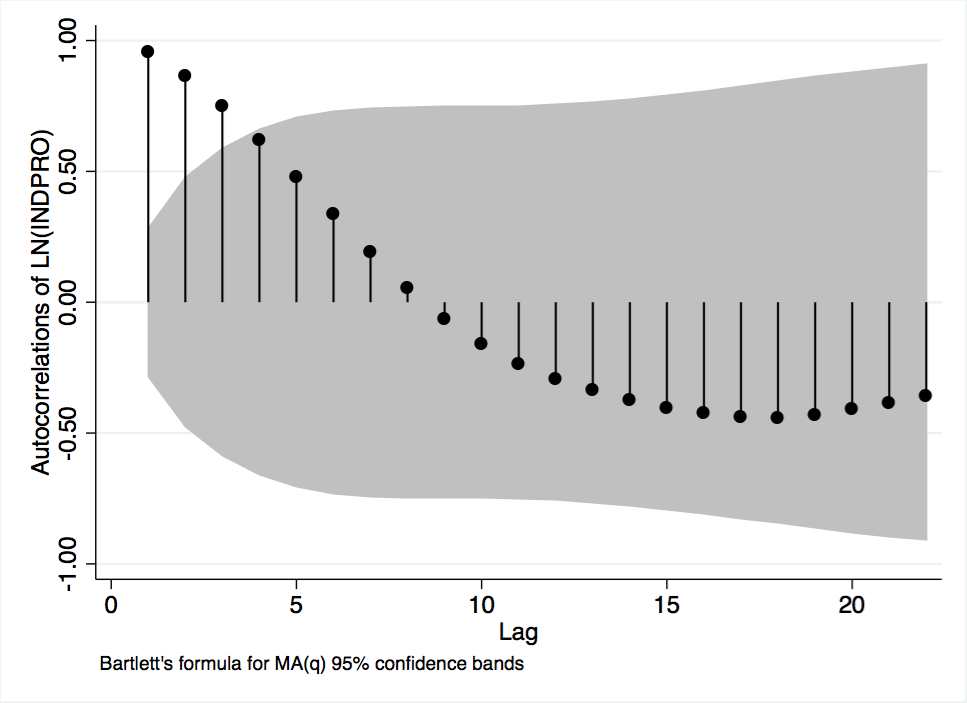

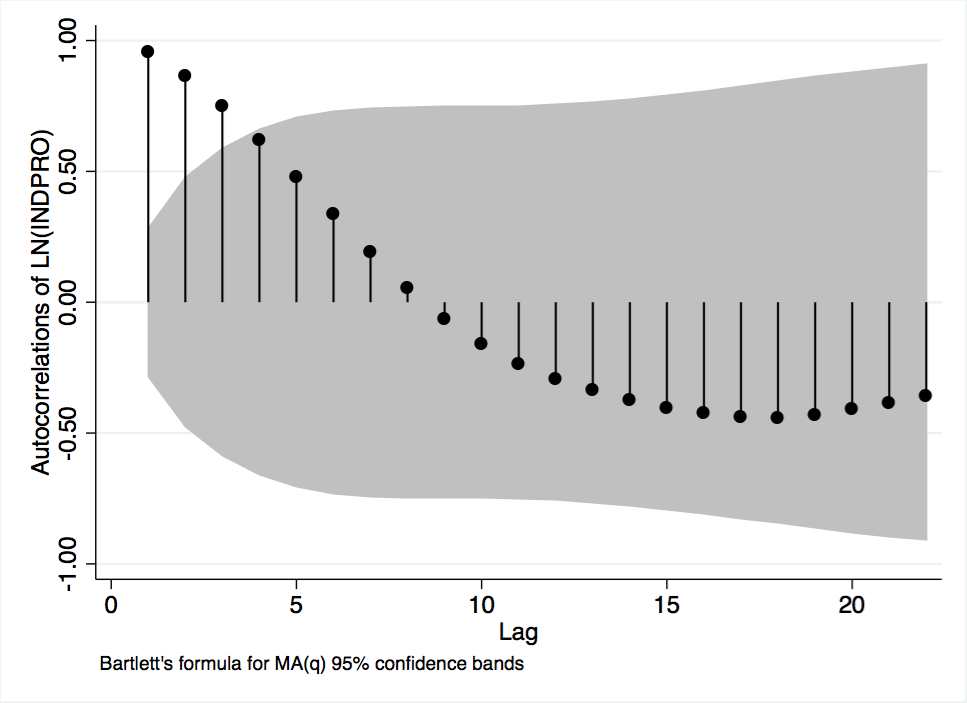

Figure A-5 Autocorrelations of Industrial Production

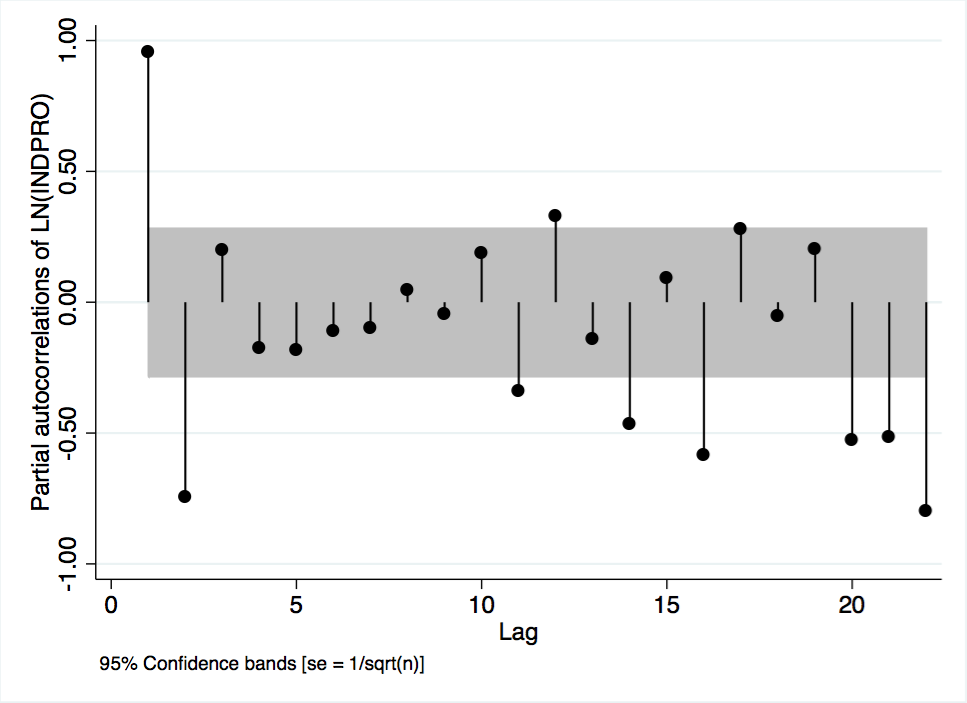

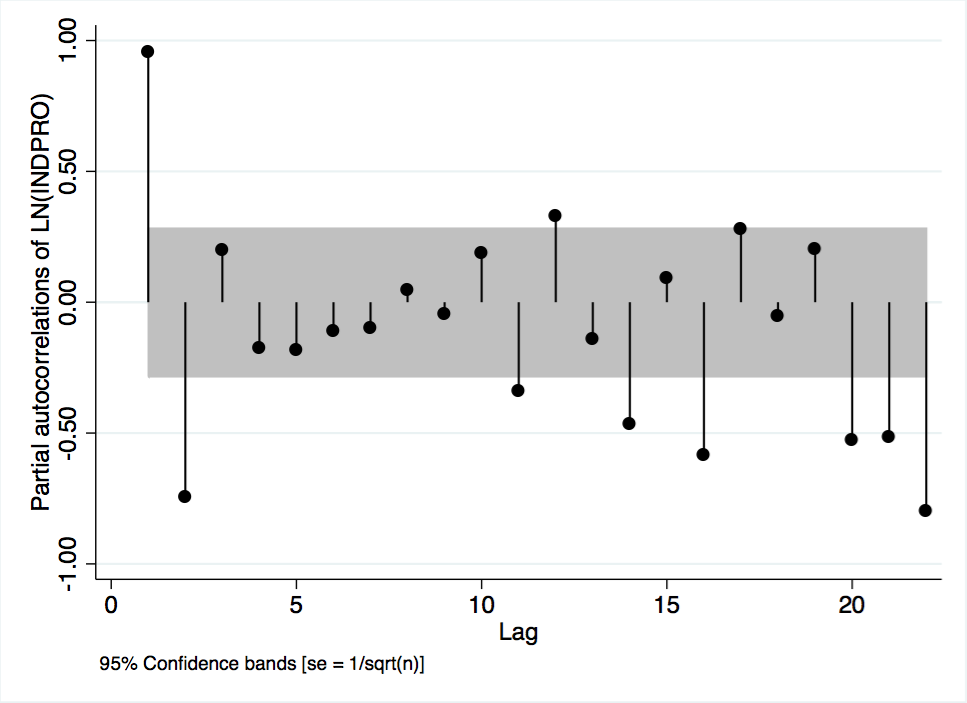

Figure A-6 Partial Autocorrelations of Industrial Production

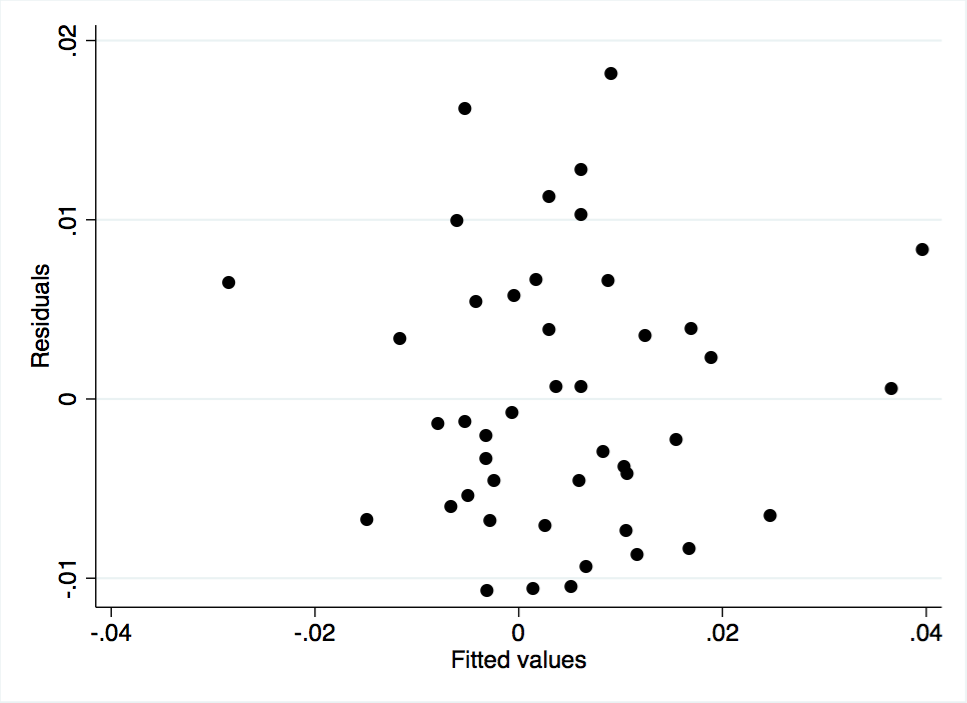

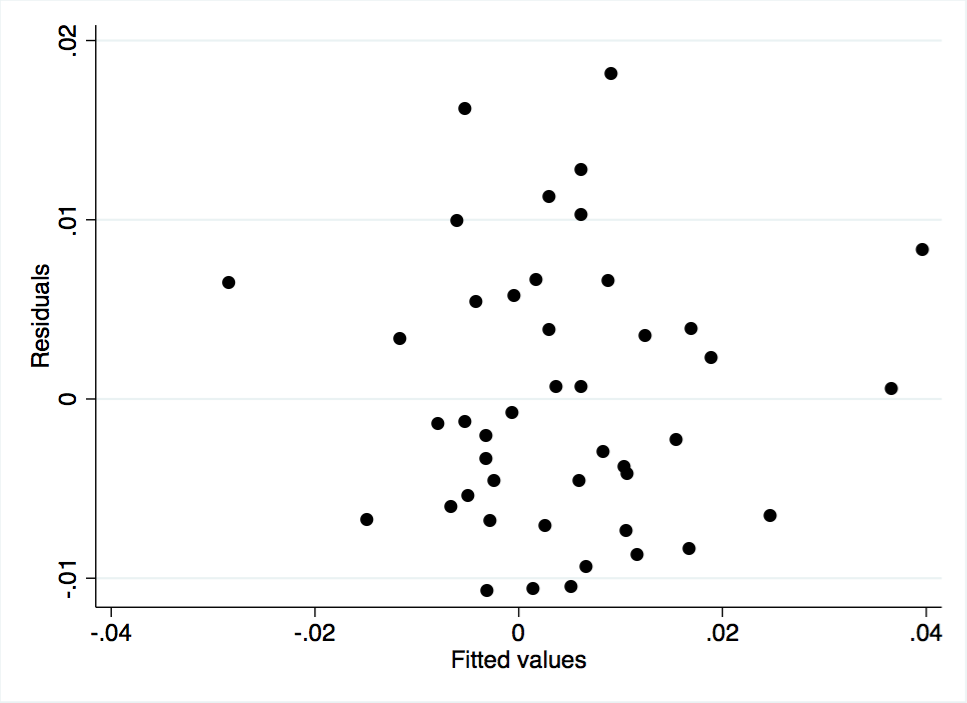

Figure A-7 Scatterplot of Model 1 Residuals Against Fitted Values

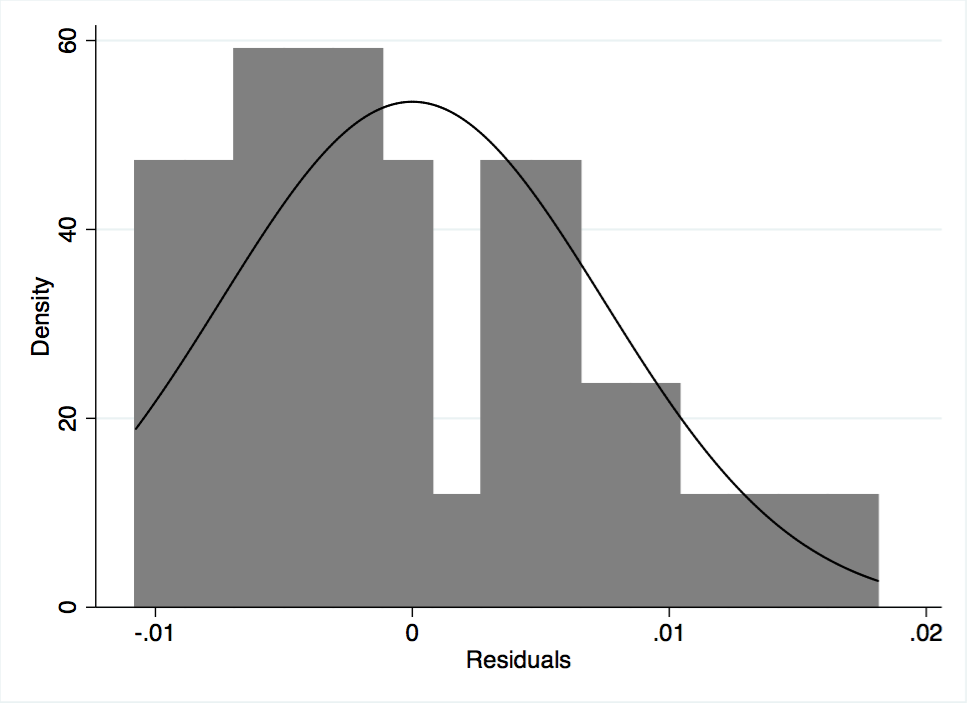

Figure A-8 Histogram of Model 1 Residuals

Figure A-9 Model 1 Residuals Plotted Over Time

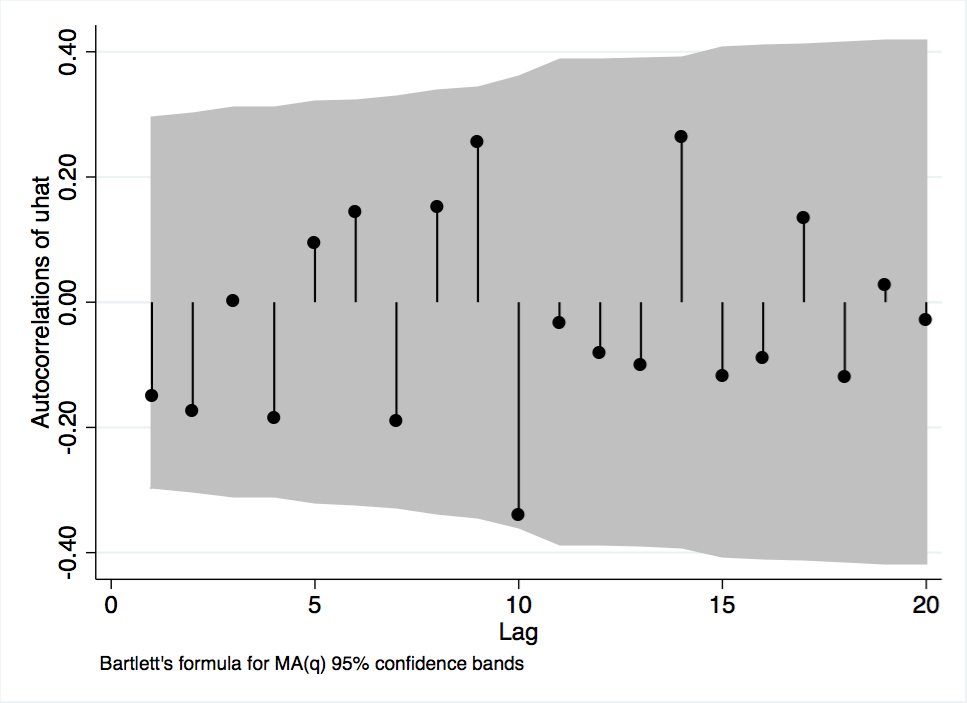

Figure A-10 Autocorrelations of Model 1 Residuals

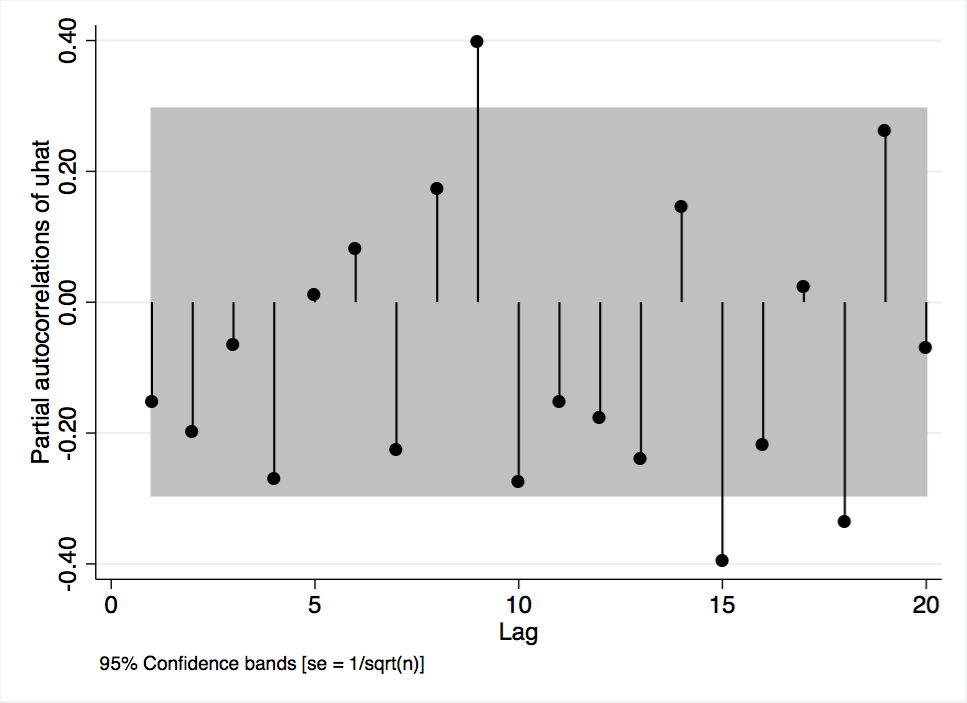

Figure A-11 Partial Autocorrelations of Model 1 Residuals

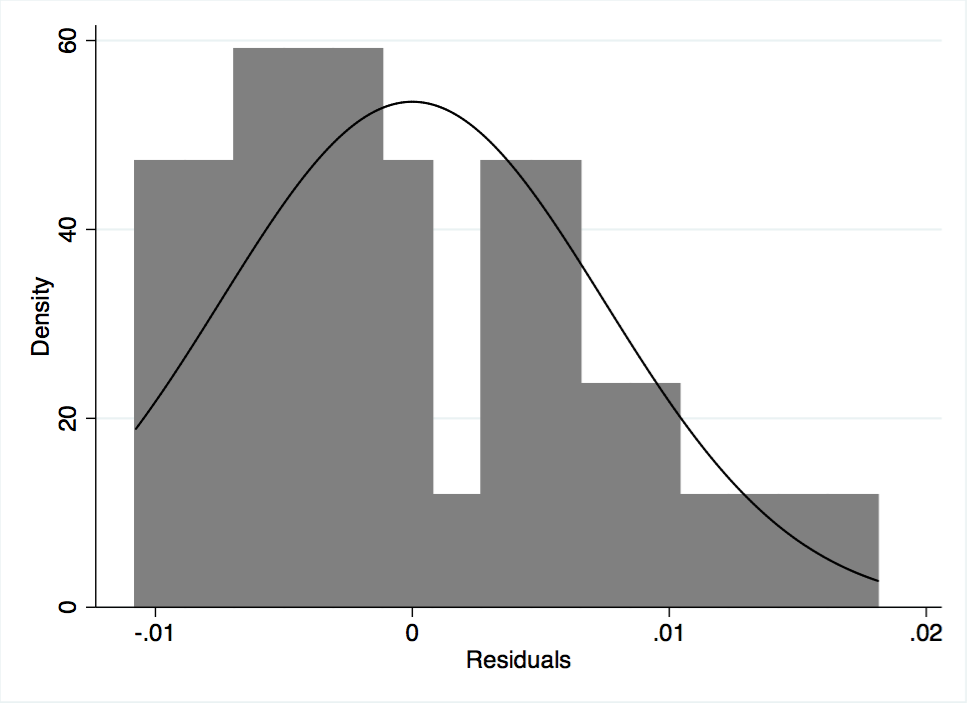

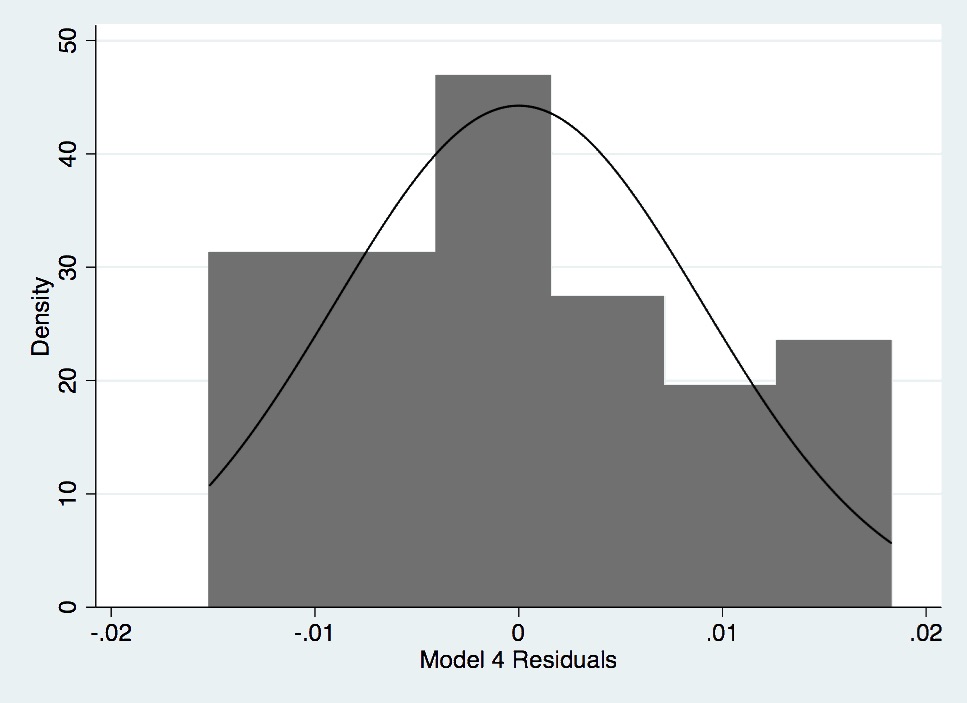

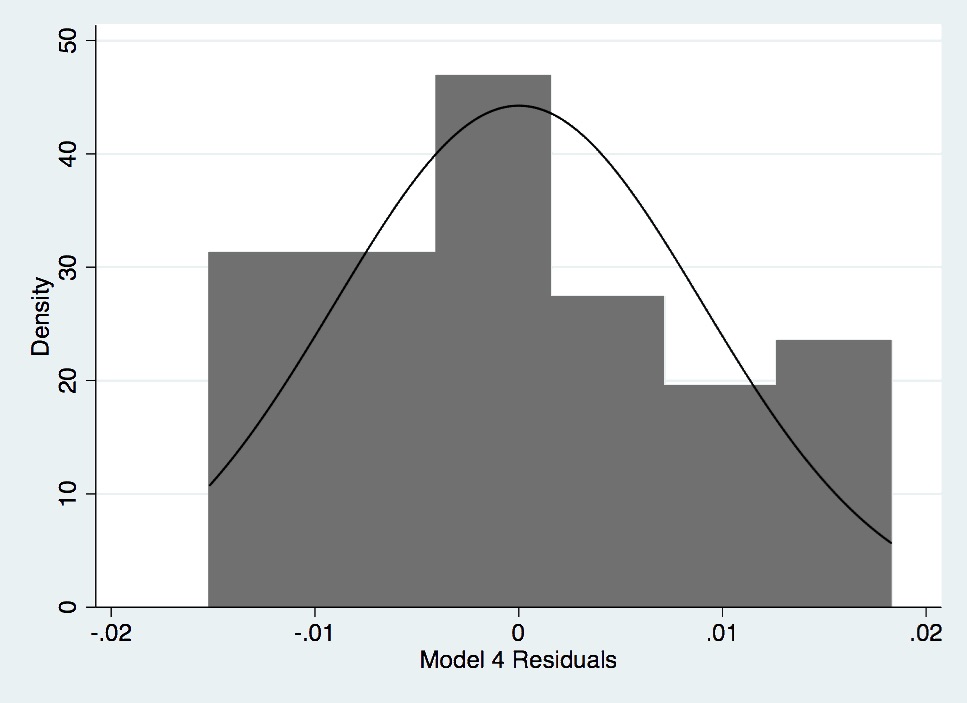

Figure A- 12. Histogram of Model 4 Residuals.

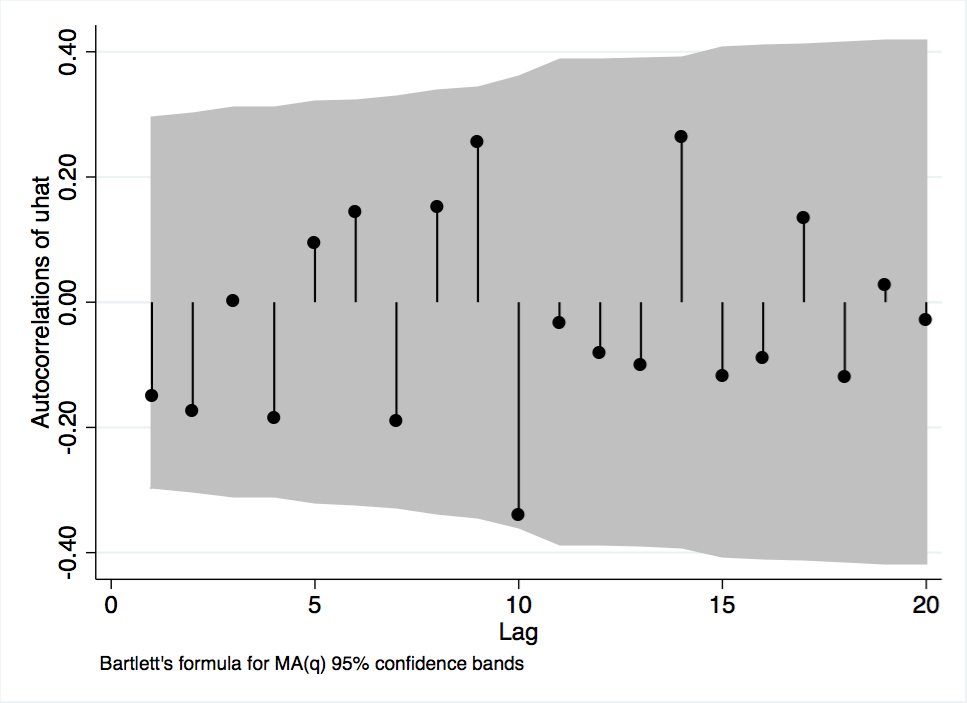

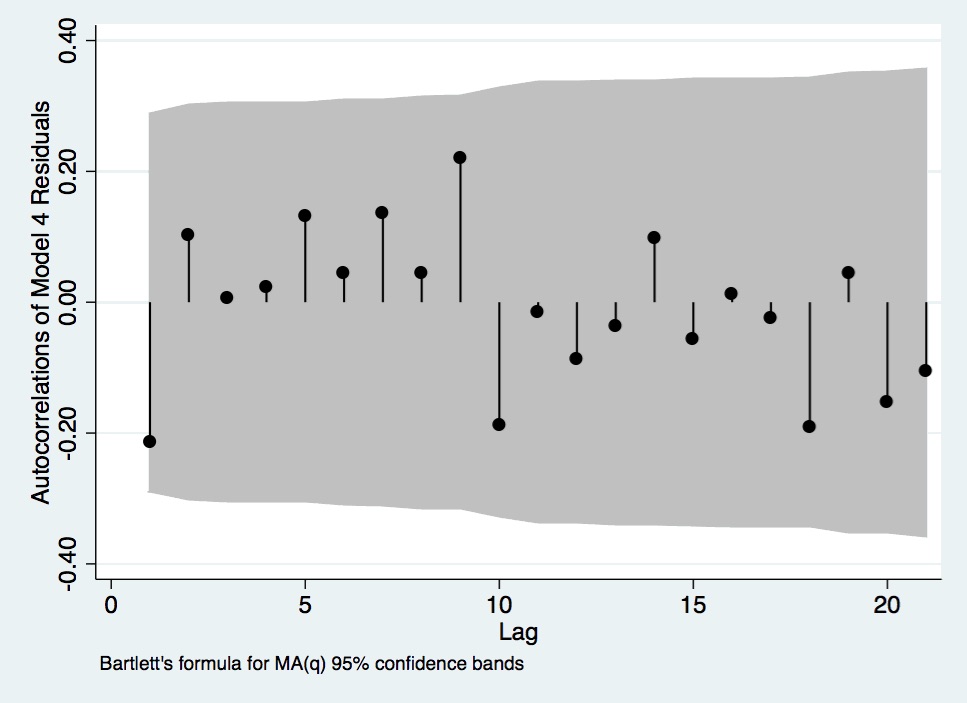

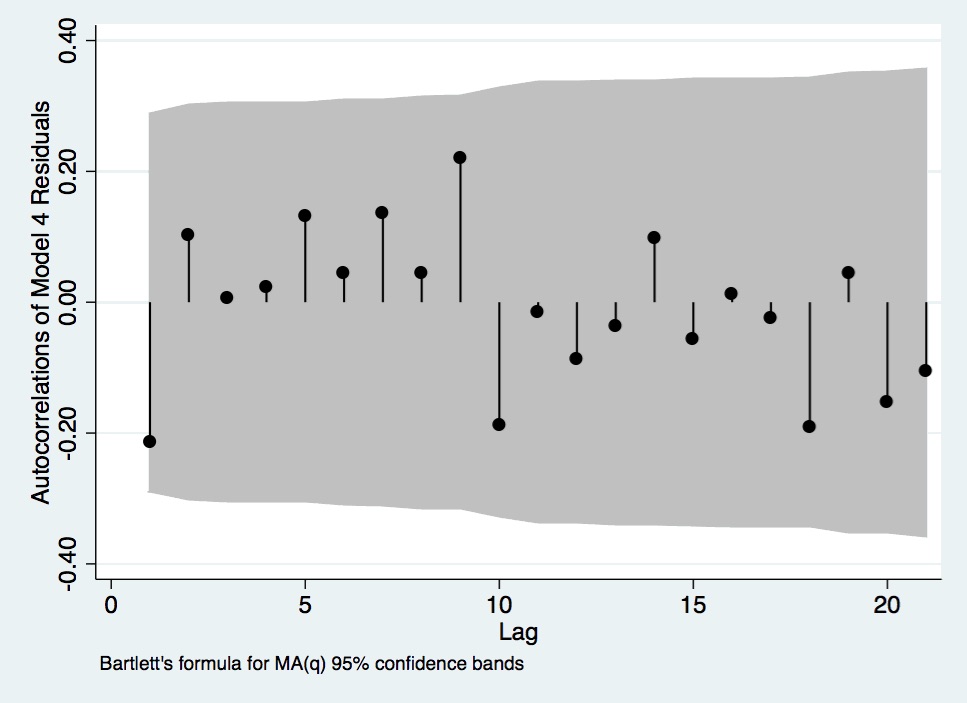

Figure A- 13. Autocorrelations of Model 4 Residuals.

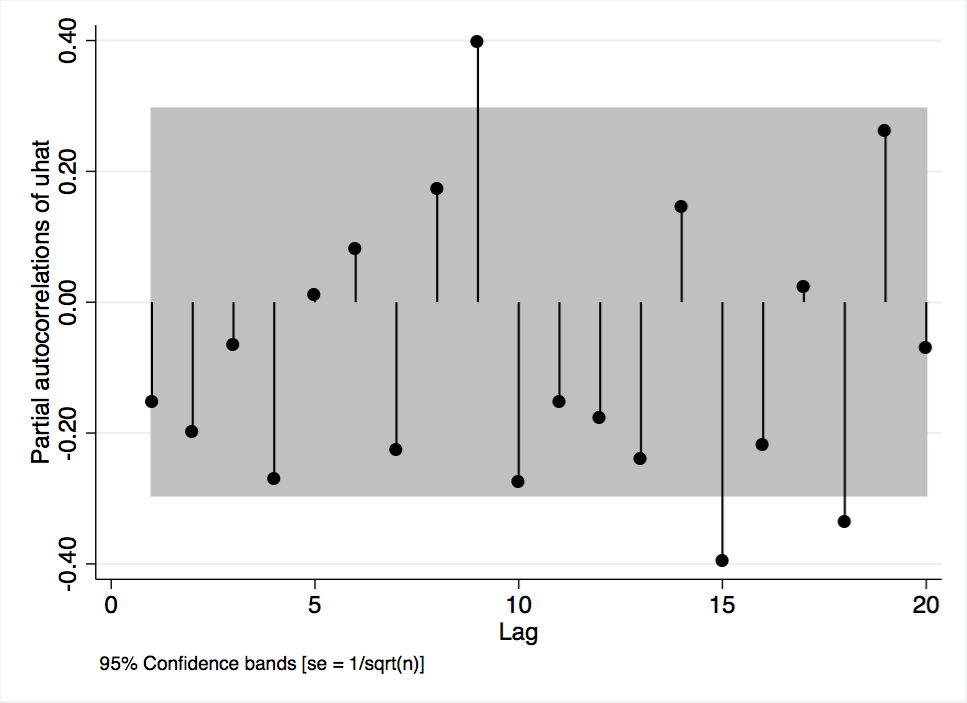

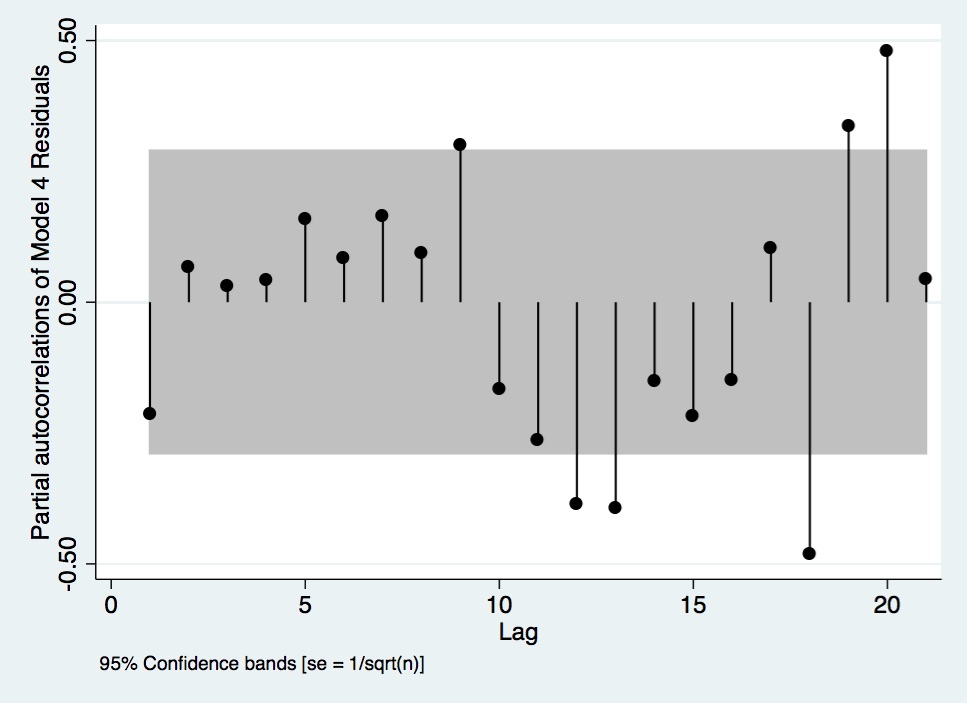

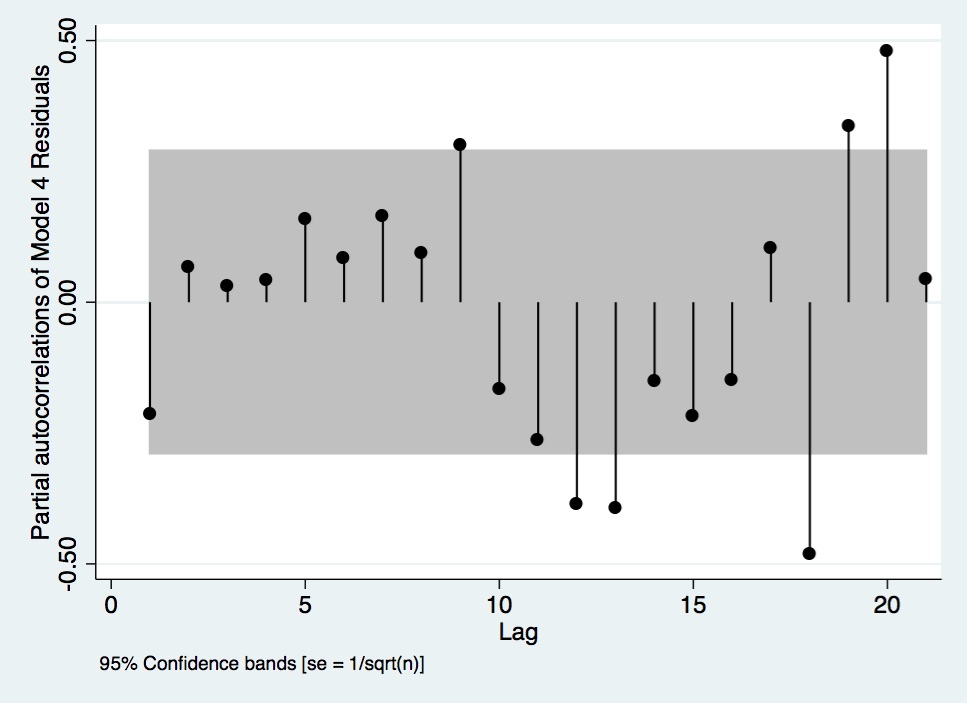

Figure A- 14. Partial Autocorrelations of Model 4 Residuals.

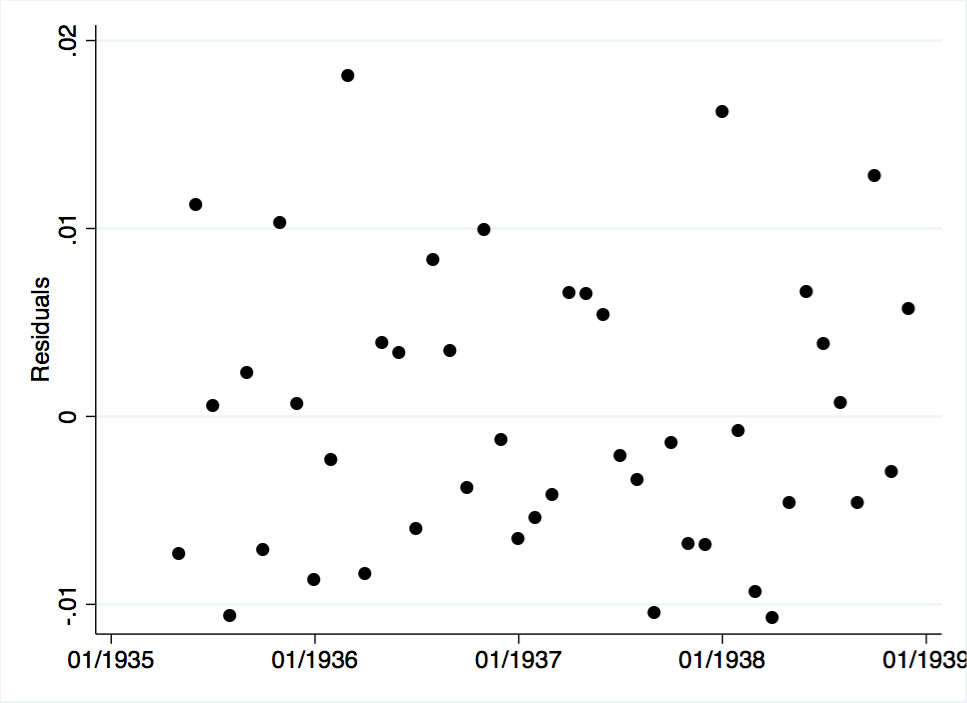

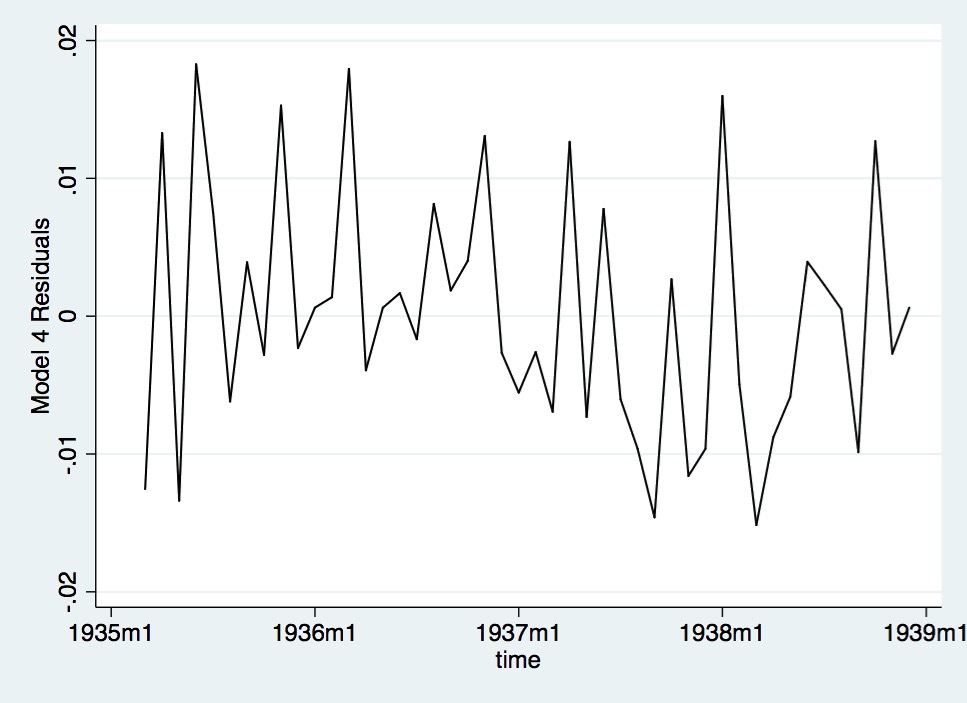

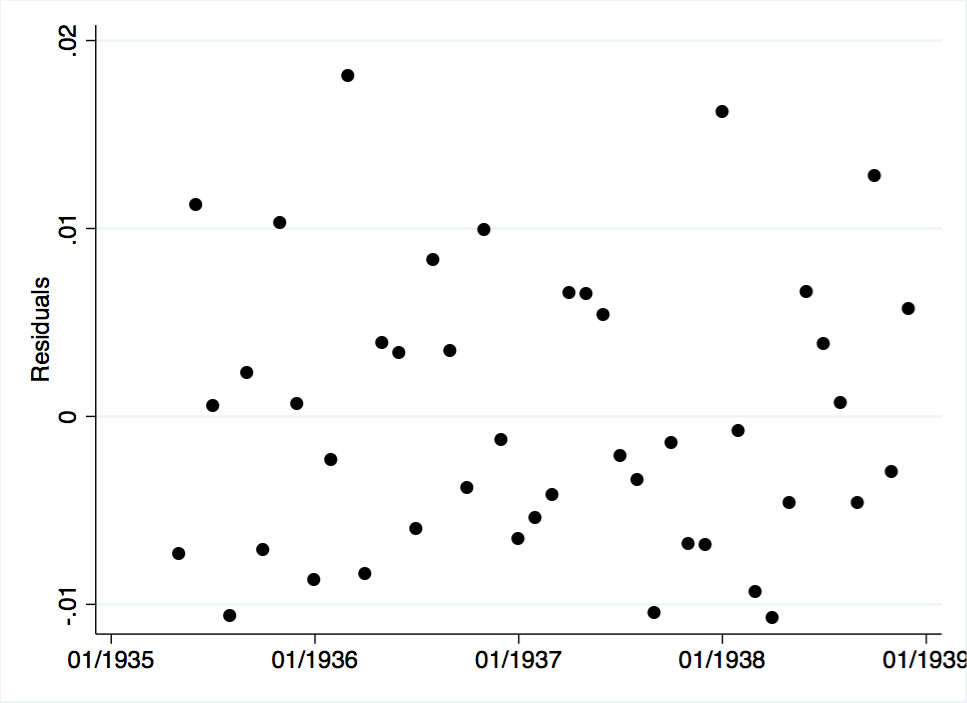

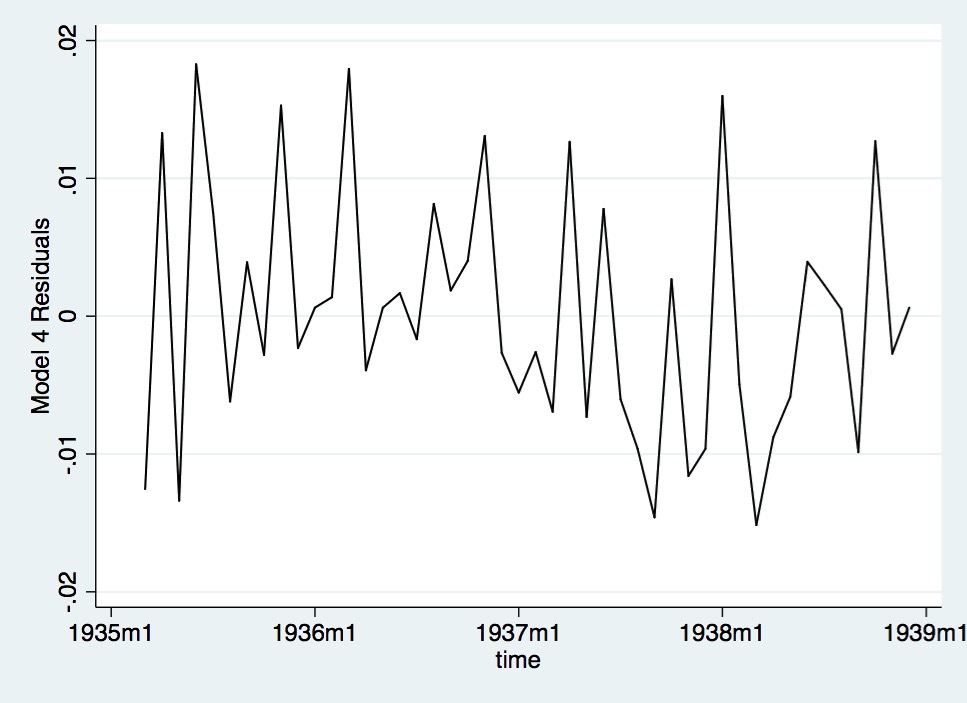

Figure A- 15. Lineplot of Model 4 Residuals.

Save Citation » (Works with EndNote, ProCite, & Reference Manager)

APA 6th

Rafti, J. (2015). "Roosevelt's Recession: A Historical and Econometric Examination of the Roots of the 1937 Recession." Inquiries Journal/Student Pulse, 7(06). Retrieved from http://www.inquiriesjournal.com/a?id=1053

MLA

Rafti, Jonian. "Roosevelt's Recession: A Historical and Econometric Examination of the Roots of the 1937 Recession." Inquiries Journal/Student Pulse 7.06 (2015). <http://www.inquiriesjournal.com/a?id=1053>

Chicago 16th

Rafti, Jonian. 2015. Roosevelt's Recession: A Historical and Econometric Examination of the Roots of the 1937 Recession. Inquiries Journal/Student Pulse 7 (06), http://www.inquiriesjournal.com/a?id=1053

Harvard

RAFTI, J. 2015. Roosevelt's Recession: A Historical and Econometric Examination of the Roots of the 1937 Recession. Inquiries Journal/Student Pulse [Online], 7. Available: http://www.inquiriesjournal.com/a?id=1053

Suggested Reading from Inquiries Journal

After years of economic downturn and recovery, the debate over stimulus packages and countercyclical policy continues globally. Proponents of such policies claim that the various stimulus packages and policy initiatives around the globe helped bring about quicker recovery, while opponents claim that in many cases these policies... MORE»

The Obama presidency will largely be defined by the administration’s ability to respond to the unique and historic challenge facing the country at the time of his inauguration: the Great Recession. This paper evaluates the president’s success throughout both of his terms in enacting an economic policy, which was largely... MORE»

The “Great Recession” of 2008 resulted in unprecedented levels of state deficit spending.[1] However, even though deficits are partly the result of economic forces beyond the control of state governments&mdash... MORE»

An exhibition entitled “The Quilts of Gee’s Bend” opened at the Whitney Museum of American Art in New York in November, 2002 (McGee), bringing worldwide attention to a secluded hamlet in a curve of the Alabama River. Unbeknownst to many of the admirers of these brightly patterned blankets was that the national spotlight had once before been shone on the town. That time... MORE»

Latest in Economics

2020, Vol. 12 No. 09

Recent work with the Economic Complexity Index (ECI) has shown that a country’s productive structure constrains its level of economic growth and income inequality. Building on previous research that identified an increasing gap between Latin... Read Article »

2018, Vol. 10 No. 10

The value proposition in the commercial setting is the functional relationship of quality and price. It is held to be a utility maximizing function of the relationship between buyer and seller. Its proponents assert that translation of the value... Read Article »

2018, Vol. 10 No. 03

Devastated by an economic collapse at the end of the 20th century, Japan’s economy entered a decade long period of stagnation. Now, Japan has found stable leadership, but attempts at new economic growth have fallen through. A combination of... Read Article »

2014, Vol. 6 No. 10

In July 2012, Spain's unemployment rate was above 20%, its stock market was at its lowest point in a decade, and the government was borrowing at a rate of 7.6%. With domestic demand depleted and no sign of recovery in sight, President Mariano Rajoy... Read Article »

2017, Vol. 9 No. 10

During the periods of the Agrarian Revolt and the 1920s, farmers were unhappy with the economic conditions in which they found themselves. Both periods witnessed the ascent of political movements that endeavored to aid farmers in their economic... Read Article »

2017, Vol. 7 No. 2

In 2009, Brazil was in the path to become a superpower. Immune to the economic crises of 2008, the country's economy benefitted from the commodity boom, achieving a growth rate of 7.5 per cent in 2010, when Rousseff was elected. A few years later... Read Article »

2012, Vol. 2 No. 1

The research completed aimed to show that the idea of fair trade, using the example of goals for the chocolate industry of the Ivory Coast, can be described as an example of the economic ideal which Karl Marx imagined. By comparing specific topics... Read Article »

|