From The Developing Economist VOL. 1 NO. 1Don't Fear the Reaper: Analyzing the Effect of Health on Microfinance Participation

IN THIS ARTICLE

KEYWORDS

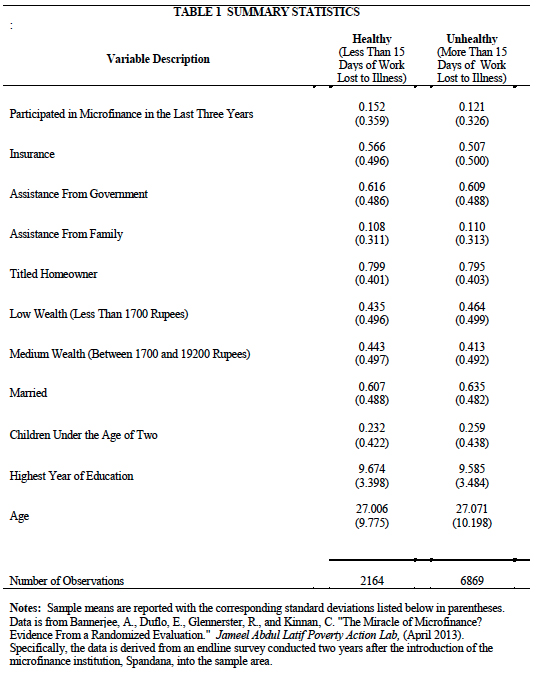

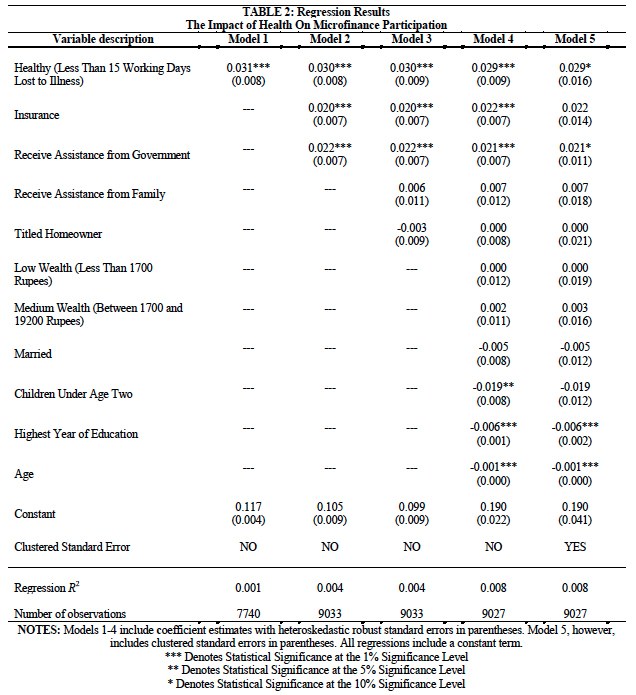

AbstractThe randomized introduction of microfinance to neighborhoods surrounding Hyderabad, India provides an opportunity to analyze the relationship between health and an individual's decision to borrow. Employing the Abdul Latif Jameel Poverty Action Lab's data from the aforementioned randomized controlled trial (RCT), I find that healthy individuals (those who lose fewer than 15 working days a year to illness) are significantly more likely to participate in microfinance. Accounting for intra-neighborhood correlation, however, the inclusion of clustered standard errors reduces the significance of said findings. This result suggests the importance of local networks in influencing investment and has broader policy implications in the need to construct a more localized, holistic model for developmental aid. I. IntroductionThe first of the United Nations' Millennium Development Goals sets the ambitious target of eradicating extreme poverty and hunger. Established at the General Assembly's Millennium Summit in 2000, the first of eight goals specifically calls for halving the proportion of people living on less than 1.25 dollars a day, achieving full and productive employment for all, and halving the proportion of people who suffer from hunger, all by 20151. Rising alongside this global target are a myriad of developmental solutions seeking, with the best of intentions, to mitigate the world's socioeconomic disparities. Proliferating from 7.6 million to 137.5 million participant families between 1997 and 2010,2 microfinance (an initiative characterized by small loans given to the impoverished) is perhaps the most prominent of the proposed panacea for the United Nations' social and economic development targets. That being said, are such microloans, in fact, a cure-all? Seeking to answer this question, the Massachusetts Institute of Technology's Abdul Latif Jameel Poverty Action Lab (JPAL) conducted a randomized controlled trial with Spandana, a microfinance institution hoping to establish itself in Hyderabad, India. Ensuring a gradual introduction of Spandana into the region, JPAL isolated the "treatment" of microcredit availability and thereby quantified its effect on the rural communities to which it was offered. While ultimately uncovering microfinance's limited role as a developmental panacea (there was no significant effect on either the expected social outcomes or on the likelihood of starting a business), JPAL's study was plagued by a conspicuous weakness: microfinance participation among eligible borrowers was only 27 percent.3 Surprised by such low participation for a program that, in its onset, was so hailed that its founder won the Nobel Peace Prize, I raise the question as to what impedes an individual's participation in such aid initiatives as microfinance. Establishing a behavioral foundation, I maintain that even the most impoverished function as rational economic actors in the pursuit of happiness and the avoidance of suffering. As such, their decisions are made on the margin. Because the impoverished frequently live in environments beset by complex vulnerability, they may lack faith in their ability to reap long run marginal benefit. In this way, cumulative risk skews the poor's decision making process towards immediate gratification and away from longer term aid initiatives. Specifically, my study analyzes the relationship between health (the lack thereof posing a significant risk factor) and microfinance participation with the hypothesis that healthy individuals will be more likely to take microloans. Because this study is largely an addendum to JPAL's analysis of microfinance efficacy in Hyderabad, India, I employ the same data set but instead seek to isolate health as a factor in their relatively low program participation. Manipulating existing statistics to serve this purpose, I created a dummy variable ("healthy") that tested positive if an individual had lost fewer than fifteen working days to illness in the previous year. The number fifteen was selected because it is the median value above which the number of days ill increases dramatically. This metric for health functioning as the model's key explanatory variable, the threat of endogeneity is mitigated by both the nature of the source experiment and the inclusion of various controls in the model. To preserve exogeneity in the initial study, JPAL randomly selected 104 participant neighborhoods, 52 of which were again randomly selected to receive the treatment: the introduction of Spandana. Such random assignment of the treatment and control groups ensures variation in the variables of interest. Additionally, the inclusion of wealth, age, education, marital status, and the presence of children under the age of two as controlling factors helps quantify otherwise unobservable variation in the model. This, coupled with the admission of insurance, titled home ownership, and government and family assistance as additional covariates, works to prevent correlation between the model's error term and its variables, thereby ensuring exogenous variation. First assuming the independence of individual characteristics, my parameter estimates suggest a 2.9 percent increase in the likelihood of microfinance participation for a "healthy" individual. This finding is both statistically (at the 1 percent significance level) and economically significant as one of many risk factors impeding investment. Similarly significant factors indicated in this study are insurance ownership as well as the receipt of government assistance. This result is logical considering that both insurance and welfare programs seek to mitigate risk. A healthy individual with both insurance and government welfare functioning as safety nets may be even more confident in his or her ability to realize a long run return on investment and thereby more willing to take a microloan. Addressing the potential for peer-group effects, I incorporate clustered standard errors into this study's final model. While "healthy" individuals remain 2.9 percent more likely to participate in microfinance, this result is statistically significant at only the 10 percent level. Similarly reducing the significance of both government assistance and insurance, these results suggest the influence of the local community on individual marginal analysis. When considering the channels of influence provided by a peer-group, this change is logical. For example, the presence of an informal insurance network or the "bandwagon effect" of neighbors participating in microfinance may partially account for variation in individual willingness to invest. While the convoluted nature of both health and neighborhood effects impair my ability to assert complete causality, the policy implications regarding the restructuring of foreign aid remain profound. In whole, the increasing economic significance of layered risk mitigation illustrates the importance of a more holistic aid program that may alleviate the complex vulnerabilities plaguing the impoverished and thus increase the efficacy of existing aid initiatives. Additionally, diminishing statistical significance upon the inclusion of clustered standard errors suggests the importance of aid initiatives tailored to local environments. The remainder of this study is organized into the following sections: background, data, empirical model, results, and interpretation and conclusion. In discussing this study's background I will define the structure of traditional microfinance initiatives and explore existing literature concerning the market repercussions of risk. Next, the data section further elucidates the nature of the JPAL study to which this paper functions as an addendum and discusses potential measurement shortfalls. The empirical model section explicitly defines the econometric model and discusses how it conforms to the underlying economic theory while also addressing potential sources of bias. Following this, the results portion will include a preliminary interpretation of both the summary statistics and the regression analysis in order to establish a mathematical foundation for subsequent conclusions. Finally, the potential for causality and the broader policy implications of this study's findings will be discussed in the interpretation and conclusions portion. II. BackgroundBuilt upon the perceived economic empowerment to be attained by universal access to credit, microfinance is fundamentally a program by which small loans are granted to poor individuals previously barred from formal banking services. Founded by Dr. Muhammad Yunus of Chittagong University in Bangladesh, Grameen Bank represents the traditional model for microfinance institutions. Specifically, Grameen loans to small groups of women who meet regularly and share liability for one another's debts. Loans are given solely to women based on the notion that they will be more likely than their male counterparts to invest in the family, thereby cultivating such social benefits as improved health and education in addition to more general financial growth. Collective responsibility and social pressure function to incentivize screening of potential group members (thus shifting the burden away from lenders) and ultimately cover the expenses if an individual borrower defaults. Consequently, Grameen is renowned for extremely low default rates and is thereby able to charge similarly low interest rates. Spandana, the microfinance institution posing the subject of this particular study, follows the Grameen model in that it loans only to small groups of eight to ten women on the basis of shared liability. The inherently small nature of microloans coupled with their gradual repayment rates make participation in microfinance institutions a decidedly long term investment. The social and economic costs associated with group lending make evident the marginal cost of borrowing; therefore, the key to augmenting microfinance participation is illustrating its long run marginal benefit. The importance of forwardthinking marginal analysis is made evident in the Hyderabad study through a disparity in results between the "business-minded" and not. Specifically, "fifteen to eighteen months after gaining access [to microfinance], households are no more likely to be entrepreneurs (that is, to have at least one business), but they are more likely to start more than one business, and they invest more in the businesses they do have."4 Recognizing this difference, the question then becomes how best to instill in an individual a mind for business, for this cadre of entrepreneurs has the most distinct marginal benefit and therefore the greatest participation incentive. The broader economic theory underlying this study is the notion that what distinguishes business and non-business minded individuals is the relative temporal depth of marginal analysis. In this way, holistic risk mitigation is essential as "a sense of stability may be necessary for people to be able to take the long view."5 Presently, there is a growing literature concerning the tendency of risk to skew an individual's cost-benefit analysis towards immediate gratification. Logically, if one lacks faith in the ability to realize investment returns, he or she may be unwilling to forego short term "happiness" (be it in the form of satellite television or tobacco) in pursuit of long term goals. Because farming constitutes the primary profession in much of the developing world, a few studies specifically address agricultural risk factors like fluctuations in crop price and rainfall. The Journal of Risk and Insurance published one such study addressing the effect of crop-price indemnified loans both on farmers' decision to borrow and their subsequent production choices. Specifically, Karlan, Kutsoati, McMillan, and Udry randomly designate treatment groups to whom they offer loans under the provision of partial forgiveness should crop prices fall below a specified threshold. To establish a basis for comparison, they also offer a more traditional loan (lacking the forgiveness component) to randomly selected control groups. Unfortunately, while there was an economically significant increase of 23.1 percentage points in agricultural investment among the treatment group (although not statistically significant upon the inclusion of all control variables), take-up of both loan structures was so high that a lack of variability in the key explanatory variable introduced bias. Moving beyond specifically agricultural risk factors, the broader cost of fear poses a similar impediment to investment. In "The Cost of Fear: TheWelfare Effects of the Risk of Violence in Northern Uganda," Marc Rockmore emphasizes intangible risk factors, for "the nearexclusive focus of the literature on the experience of violence ignores their losses due to persistent insecurity and uncertainty."6 First employing geo-spatial data on violent activity to construct a model of real (the probability of a community being attacked in 2004) and perceived (apparent insecurity within the area) risk, Rockmore proceeds to analyze the relationship between the aforementioned model's fitted values and geographic welfare effects. Proxying welfare in terms of per capita household expenditure, there is a statistically significant decrease in consumption of three and eight percent for households exposed to objective and subjective risk, respectively.7 In a similar study, Londona, Mora, and Verwimp postulate that "the threat of violence or the anticipation of violent shocks oblige rural households to revert to subsistence agriculture and shift portfolio to less risky, but also less profitable activities."8 Empirically analyzing this notion, the authors employ municipal data regarding military action against the civilian populace averaged between 1998 and 2008, the percentage of municipal hectares devoted to coca cultivation, the percentage of land allocated to coffee, and a variety of other economic covariates to model the relationship between risk and coffee production. Recognizing that "abandoning coffee production is an extreme strategy households may adopt to mitigate the impact of shocks or to reap the short-term benefits of coca production,"9 this relationship applies to my study as an example of the broader tendency of risk to skew marginal analysis towards short-run benefit. While the regression statistics suggest that an increase in one standard deviation of average military action coincides with a 0.02 standard deviation decrease in the percentage of land devoted to coffee production,10 the inherent difficulty of quantifying the amount of illegal coca production impedes the authors' ability to move beyond conjecture in terms of the farmers' transition from long-run to short-run profitability as embodied in the shift from coffee to coca cultivation. Recognizing that "abandoning coffee production is an extreme strategy households may adopt to mitigate the impact of shocks or to reap the short-term benefits of coca production,"9 this relationship applies to my study as an example of the broader tendency of risk to skew marginal analysis towards short-run benefit. While the regression statistics suggest that an increase in one standard deviation of average military action coincides with a 0.02 standard deviation decrease in the percentage of land devoted to coffee production,10 the inherent difficulty of quantifying the amount of illegal coca production impedes the authors' ability to move beyond conjecture in terms of the farmers' transition from long-run to short-run profitability as embodied in the shift from coffee to coca cultivation. Slight biases notwithstanding, these studies are exceedingly relevant as the threat of violence poses a level of uncertainty comparable to poor health, and "the literature on choice under uncertainty provides a framework for understanding the role of risk in household decisions."11 My paper improves upon the existing research, however, by employing a specific aspect of the larger, often intangible vulnerability networks to a partial explanation of Spandana's conspicuously low participation rates. From a policy perspective, my study further advocates "the importance of subjective risk [in] the provision [that] aid may need to be reconsidered."12 III. DataAs mentioned above, this study functions as an addendum seeking to partially explain low participation rates among eligible borrowers in JPAL's analysis of microcredit efficacy: "The Miracle of Microfinance? Evidence from a Randomized Evaluation." Consequently, I utilize JPAL's data set in analyzing health as an impediment to borrowing among their targeted sample population. More specifically, I derived both demographic statistics and loan information from a comprehensive endline survey conducted three years after the controlled introduction of Spandana. Considering the study's setting in rural communities surrounding Hyderabad, India, there was no accurate census data. As a result, JPAL commissioned a hasty baseline survey in order to attain basic information by which to determine eligible neighborhoods. With the intention of surveying 20 households per neighborhood, field officers mapped prospective communities and selected every nth house. Ultimately, 2,800 households were surveyed and 104 neighborhoods deemed eligible. Of these, communities were paired by common characteristics with one of each couple allocated to the treatment group to host a newly created Spandana branch. With the experimental groups thus created, field officers conducted two comprehensive household surveys (65 homes per neighborhood for a total of 6,850) spaced one and three years following the initial introduction of Spandana. The homes selected were those with the highest likelihood of having borrowed: residents of the area for a minimum of three years with at least one woman between the ages of 18 and 55. The latter of these two assessments constitutes the final endline survey from which I derived my cross-sectional data set. While the comprehensive nature of the endline survey largely mitigates the threat of sampling error (nearly every household eligible to receive a microfinance loan was assessed), survey data is inherently flawed due to the prevalence of measurement error. Namely, while the dependent variable is a simple question of whether or not the individual has taken a microloan in the past three years, the key explanatory variable (the number of days lost to illness in a year) is more difficult to precisely recall. Because I opted to construct a binary variable deeming "healthy" those individuals with fewer than 15 working days lost to illness, such rounding error is significant on the margin of healthy and unhealthy. That being said, there should be an equal likelihood that surveyed individuals either under or overestimate the number of days ill, so the overarching effect should be minimal. Additionally, rounding error in the endline survey is prevalent in the valuation of one's household assets. Similar to the reported number of sick days, issues arise on the margin of low and medium wealth (1,700 rupees). As may be referenced in the attached summary statistics (Appendix A), the percentage of individuals deemed to be of medium wealth and the percent considered of low wealth are fairly equal. Considering the relative poverty that makes these neighborhoods desirable for microfinance involvement, these findings could potentially be skewed to wards higher wealth by social desirability bias. Furthermore, the percentage of households receiving family assistance (conspicuously low despite the historic prevalence of such informal insurance networks), may also suggest a slight social desirability bias towards perceived self reliance. Ultimately, the meticulous construction of the randomized controlled trial from which my data is derived reaffirms its ability to produce useful results. While some measurement error may stem from the data being survey based, rounding error and social desirability bias should have minimal effects on the few explanatory variables that require more specific reflection. Namely, rounding may conceivably occur either above or below the true value, and the relatively uniform poverty of the area in question should minimize the desire to artificially inflate one's wealth. Otherwise, the comprehensive screening of randomly selected control and treatment groups should ensure a representative sample with sufficient variation in the explanatory variables to produce meaningful results.Continued on Next Page » Suggested Reading from Inquiries Journal

Inquiries Journal provides undergraduate and graduate students around the world a platform for the wide dissemination of academic work over a range of core disciplines. Representing the work of students from hundreds of institutions around the globe, Inquiries Journal's large database of academic articles is completely free. Learn more | Blog | Submit Latest in Economics |